As in previous years we’ll set out the most common optimum, then end with a few exceptions. There are negligible significant changes between 2018/19 and 2019/20, mainly just inflationary increases to most thresholds. Just to clarify the below are suggestions in for the tax year starting from 6 April 2019.

The “most common” situation:

For one person companies in 2019/20, we recommend a salary of £719/month. This replaces £702/month for 2018/19. It’s the maximum before NICs actually become payable, yet is still sufficient to count as a contributing year towards basic state pension.

On the basis of that salary (so £8,628 for the year) and no other personal income, you can take dividends of:

– £5,872 and suffer no personal tax (0%)

– £41,372 (ie an extra £35,500) and suffer £2,662.50 personal tax (£35,500 at 7.5%)

– £91,372 (ie an extra £50,000) and suffer £18,912.50 personal tax (the above £2,662.50, plus £50,000 at 32.5%)

The above thresholds are not hard limits, just the levels above which the marginal rate of tax increases (ie the amount of tax suffered on each extra £ of dividend taken). Above the top limit you start to lose your personal allowance so the effective tax rate becomes increasingly penal.

Exceptions:

– 2+ staff – for those with 2+ people on the payroll but overall very modest salaries (so £3k employment allowance won’t be fully utilised) and preferring tax savings over simplicity, you may choose to opt for the slightly higher salary of £1,041/month (equivalent of £987/month for 2018/19). This will incur employee NICs, but still no PAYE as under the personal allowance, and the employment allowance will negate the employer NICs. In practice this will save a couple of hundred quid over the year, but be aware staff net pay won’t consistently equal their gross pay, so there will be deductions to pay over to HMRC. Please also note this extra £3,864 salary over the year impacts on the dividend thresholds, so basically £2k tax free, £35.5k basic rate (£37.5k total dividends), £50,000 higher rate (£87,500 total dividends). If in doubt, just go for the lower £719/month, it costs negligibly more and avoids complications.

– Student loans/higher income child benefit charge – these aren’t really exceptions as such, but things to be aware of that can increase what you have to pay. If you have an outstanding student loan or claim child benefit, and your total overall income is above £21,000 or £50,000 respectively, then there will be additional charges of loan repayments and/or having child benefit clawed back.

If you don’t want to be overly concerned with the precise details, then the general logic isn’t surprising. In the vast majority of situations, as personal income goes up, the tax rate goes up.

Also, don’t be concerned about possibly dribbling just above a threshold. If for example you went £10 into the higher rate band, it just means that top £10 of your income would suffer 32.5% instead of 7.5%. There’s no sudden sting for going pennies above a threshold.

How to enrol for MTD

The first compulsory MTD submissions are for VAT quarters starting 1 April 2019. So unless you’ve got a shortened quarter for some reason, quarters ending 30 June 2019 and onwards. This post should help you with the sign up process.

Overview of what needs doing

We will assume for this purpose that you already use MTD ready software (eg FreeAgent) for your bookkeeping. If you don’t, you’ve got a much bigger upheaval, as you may well need to change how you do your bookkeeping. Discuss with your accountant if you’re unsure.

On the basis you are using MTD ready software, the hassle is modest, and change other than short term tweaks is trivial. For the time being at least, only the numbers in the VAT boxes are submitted, and only when you click the button to submit. However behind the scenes it’s being transmitted in a different way. Prior to MTD, data is submitted as/when instigated by you, with you needing to add your HMRC Gateway ID details each time, as they’ll go with the submission to show it’s from you. Post MTD, you’ll be setting up a permanent link between your bookkeeping software and HMRC portal. So when you come to submit data, it will be quicker and you won’t have to re-enter ID/password, as it’s not revalidating anything.

Steps below:

1) Make the required tweaks to your HMRC portal account. It’s critical this step is done before any changes to your bookkeeping software. Reason being the HMRC side is the tricky bit (more down to their poor UX than anything else), and all sides need to be aligned. Ie if you tweak your FreeAgent account to opt for MTD, then struggle with the HMRC side, you’ve got a problem. Given how unfriendly the HMRC side can be, we’ve got a step by step “what to click where” guide further down.

2) There’s a button that either user or accountant can change on FreeAgent to switch the account over to MTD. I believe this is hard/impossible to reverse…so do step (1) first!

3) This will add a new settings menu to FreeAgent (NB typically your accountant cannot see/alter this bit), where you need to link FreeAgent up with your portal. Ie tell FreeAgent your HMRC gateway ID and password.

4) You’re done! Next time you go to submit a VAT return, it will look slightly different, but you’ll barely notice.

HMRC portal step by step

If there is a painful bit, it’s this. We’ve run through it recently and taken screen prints of every step. Unfortunately HMRC are constantly tweaking things, so inevitably it won’t be long until the process deviates slightly from what’s below, but hopefully you can follow it easily enough!

Your HMRC portal account must already be enrolled for online VAT services. If you’re unsure what I mean by this, you’ve got some more basic bits to deal with first, discuss with your accountant.

From here we’ve used red text for our comments to help them stand out from text in the many screen prints.

1) URL to start is https://www.tax.service.gov.uk/vat-through-software/sign-up/have-software

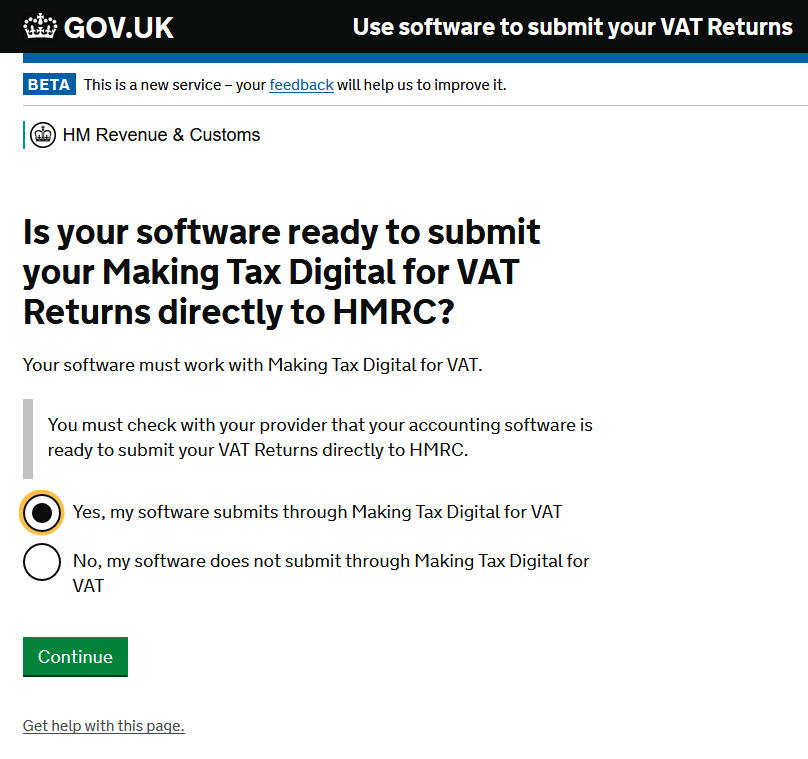

2) Yes you have suitable accounting software (assuming you already use FreeAgent/equivalent):

3) …and yes, FreeAgent is ready for MTD:

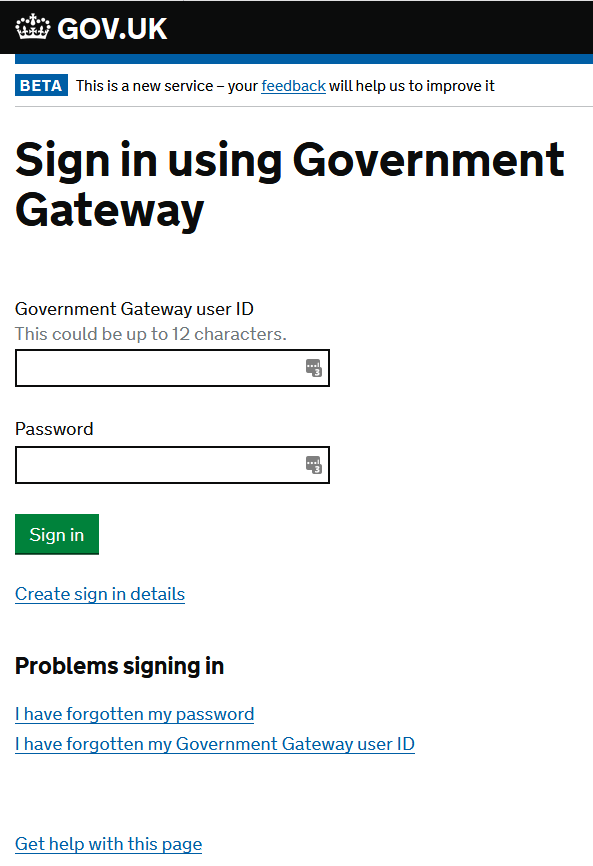

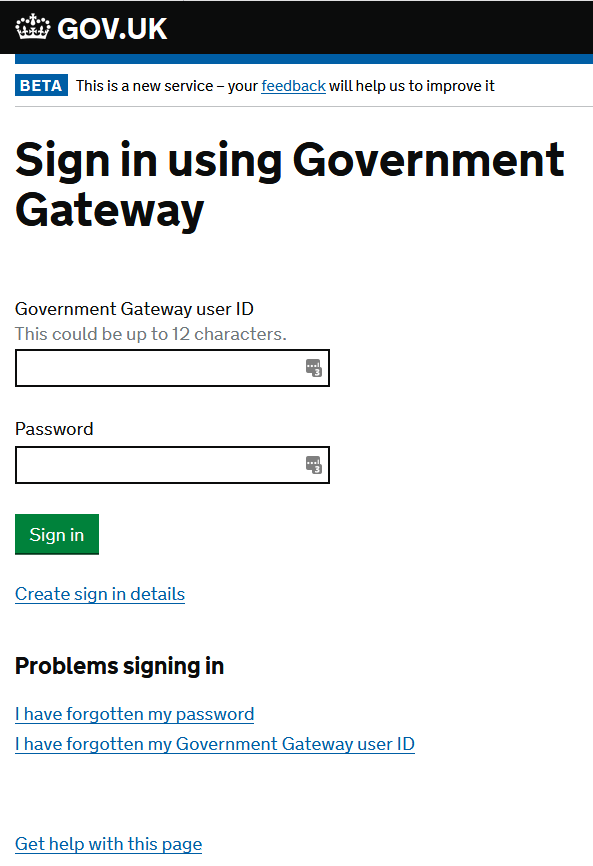

4) Enter your gateway ID and password (hopefully you know these!). NB after entering these you may have to enter an access code/be suggested you set up security back up etc depending upon the settings in your account:

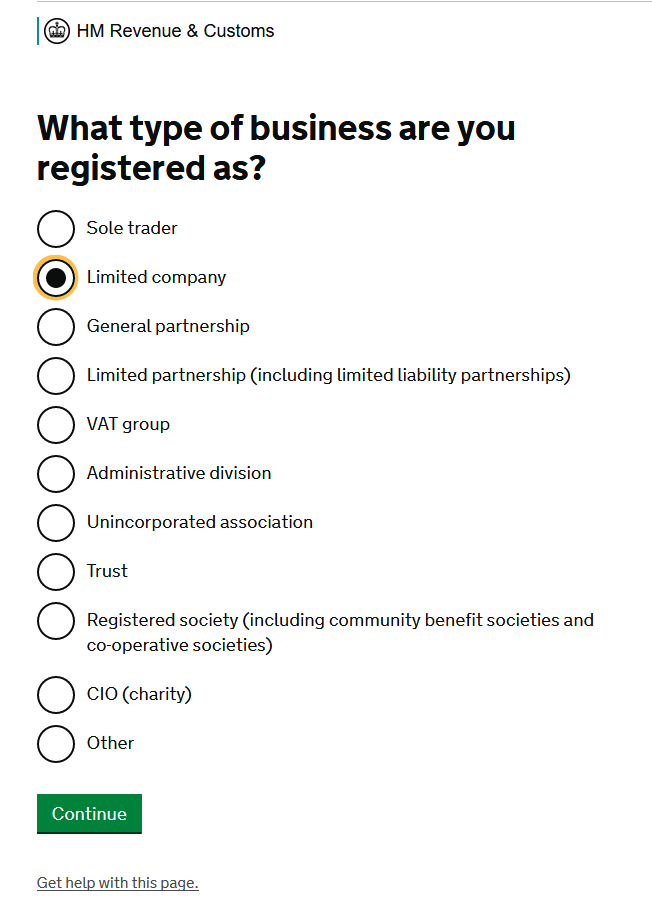

5) We’ll assume for this purpose you just have one business(!)

6) …and it’s a Ltd Co:

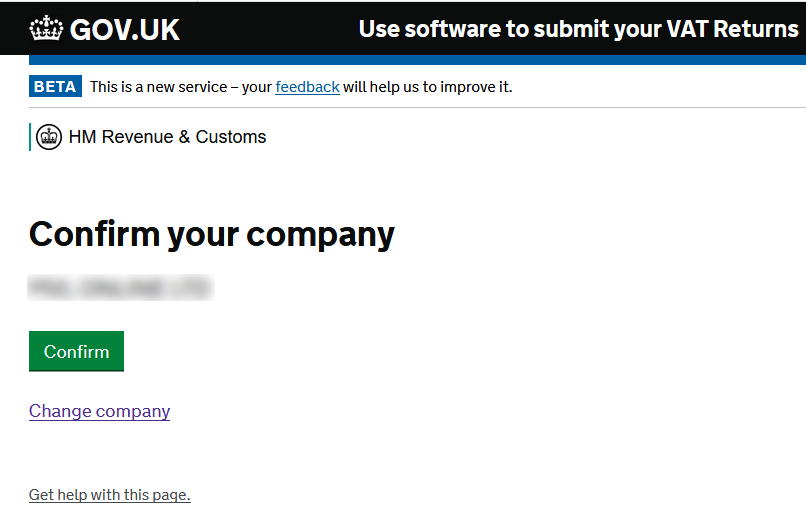

7) Enter your Cos Hse registration number (if you’re unsure, either ask your accountant or search for your company name from https://beta.companieshouse.gov.uk/):

8) …and confirm it’s the right one:

9) What is your company’s Unique Taxpyer Reference number? (sometimes referred to as your corporation tax UTR, your accountant should know if you’re unsure):

10) What’s your email address:

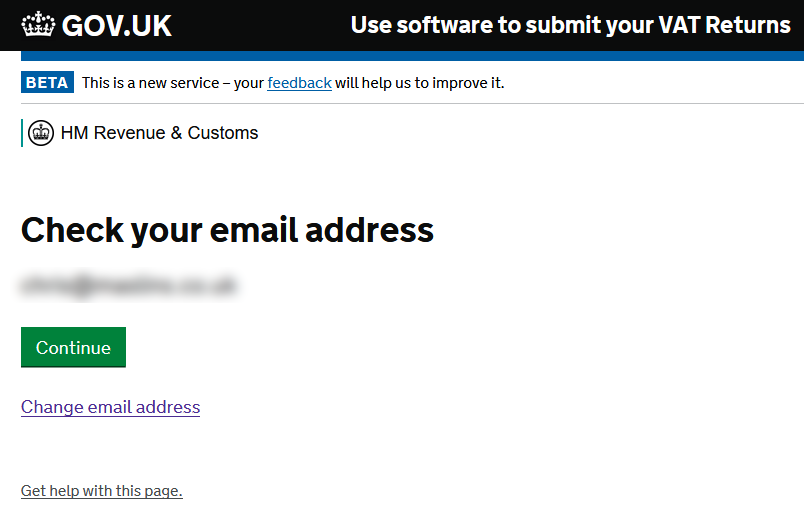

11) Check email address for typos:

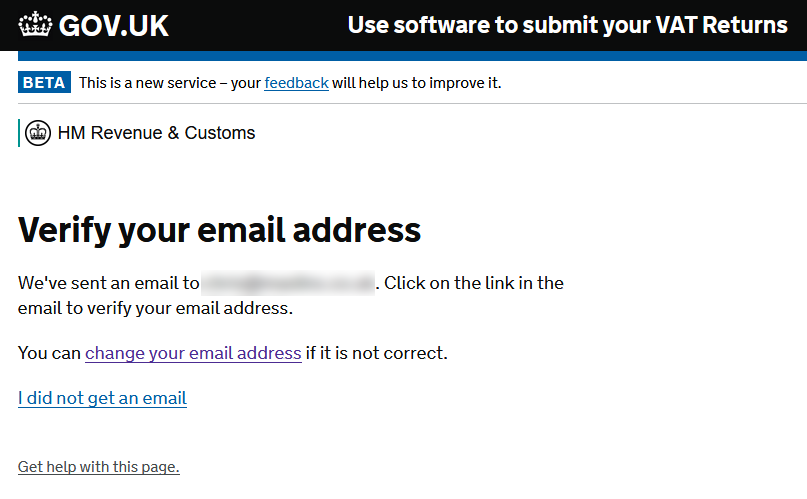

12) Verify email address:

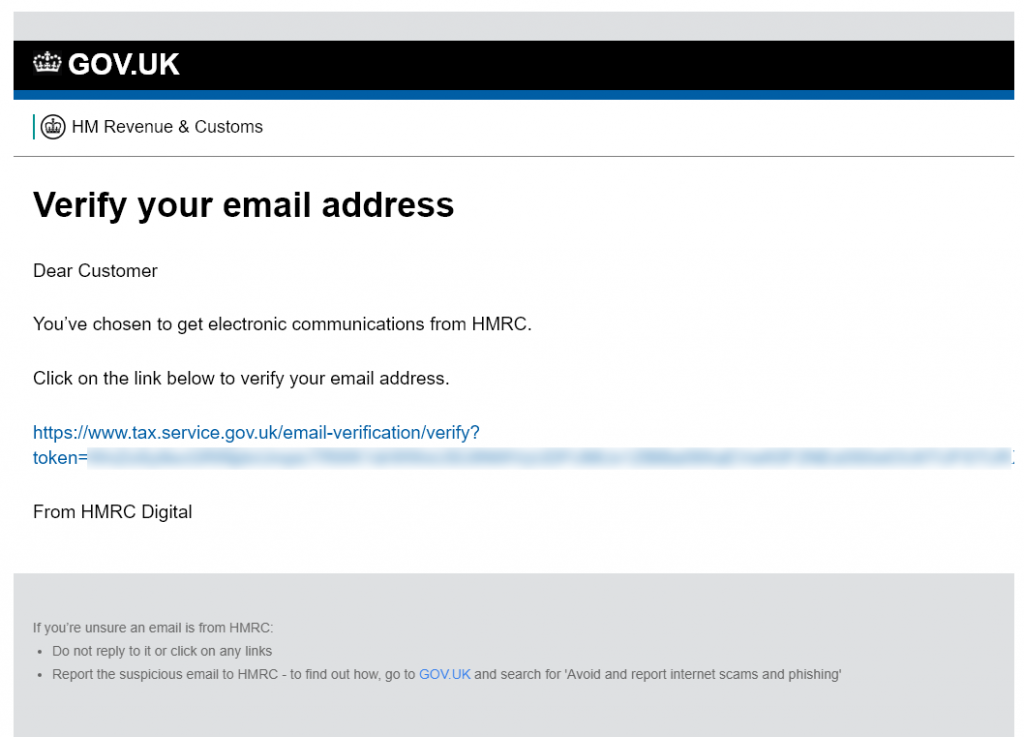

13) NB this next one is from an email received, not following the webpage:

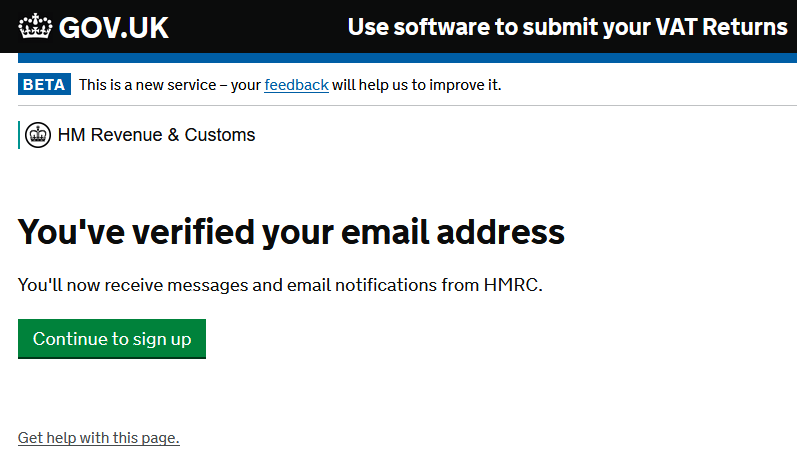

14) Email verified:

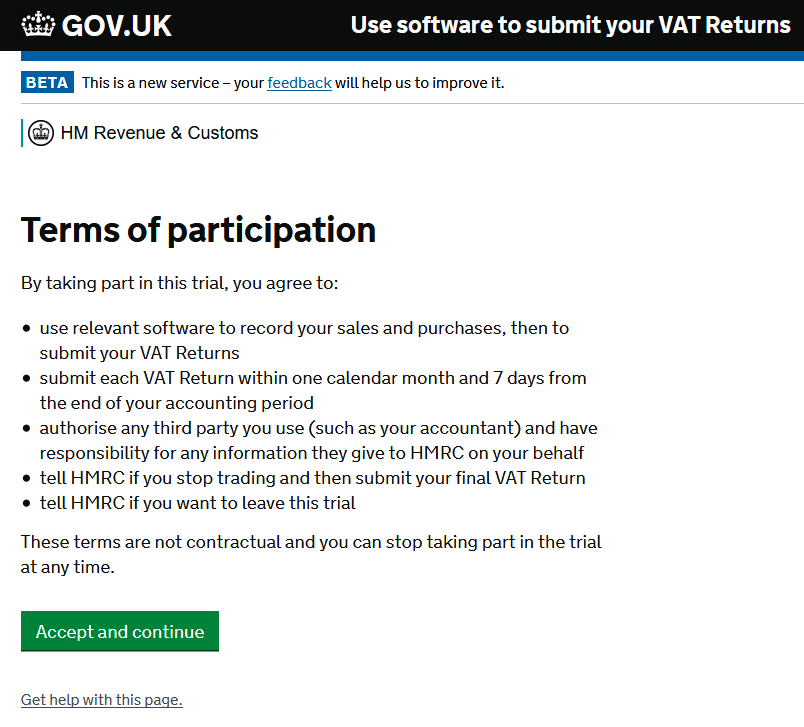

15) You sure you know what you’re letting yourself in for(!):

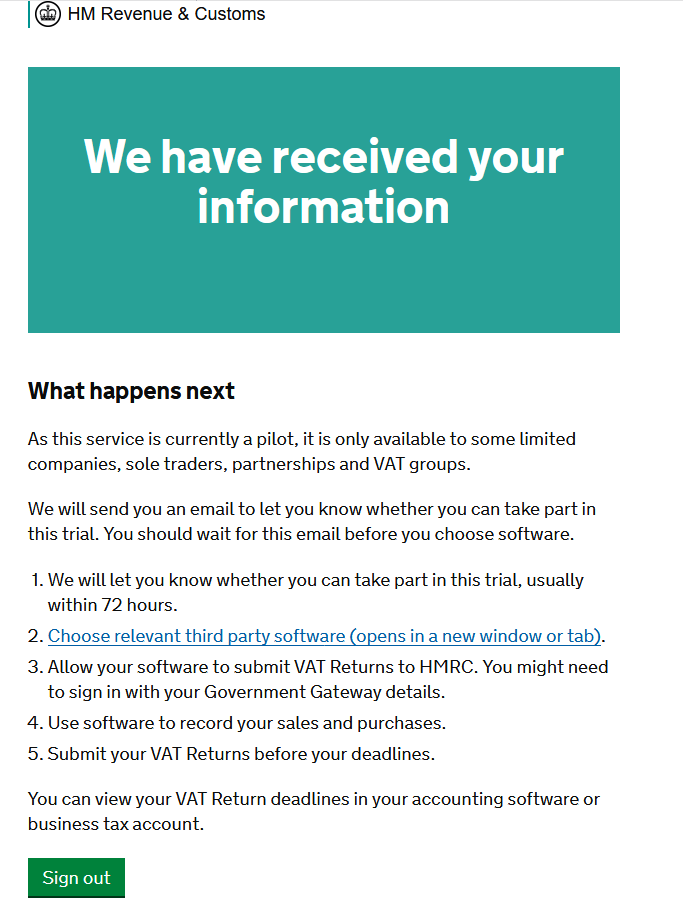

16) Next page should be confirmation you’ve done all you need to…for now.

As it suggests, patience from here. Hopefully within a few working days you’ll get a further email from HMRC confirming acceptance onto the pilot. Once you’ve got that, move on to the FreeAgent bit which is a doddle/lightning quick in comparison (other software packages will likely have something similar).

****A FEW DAYS DELAY****

17) Hopefully you’ll get an email like the below:

That’s the painful bit done!

FreeAgent settings to tweak

On FreeAgent, go to “Connections” (just under “Settings” (from top right):

Then under the menu you should see a new option “HMRC Connections”:

You should see a page like the below:

Click the big green button, which then takes you to an HMRC page again:

Click “Continue” and you’ll need to provide your 12 digit HMRC gateway ID and password one more time:

Then click “Grant authority”

Following that, you’re done. You should revert back to FreeAgent and see:

From now on, you’ll barely notice the difference. You’ll still submit VAT returns from FreeAgent, only difference of note for you as a user is that you won’t need to put in your HMRC gateway ID and password each time, as there’s a permanent link already set up.

How to enrol for online VAT services

HMRC aren’t renowned for having the most intuitive, easy to use systems. We typically do the actual VAT registration process for clients, but we then need them to enrol for online VAT services. The fact this blog post has 10 screen prints to show you the steps to take demonstrates this isn’t overly easy. Hopefully the below will be valid for at least a while before HMRC inevitably change things again!

One thing to stress – if you/your accountant has literally just had the message confirming successful VAT registration, be aware it’ll likely be at least a couple of working days before the details will be accepted in the final step. For whatever reason HMRC are able to give you VAT details a couple of days before they’ve fully filtered through their own systems. If you try too early, the details will be rejected even if perfectly accurate. Try again a few days later.

You need to start from https://online.hmrc.gov.uk/login UPDATE – the page has changed a bit, relevant link may instead be “Create sign in details”

Assuming this is the first time you’ve landed on that page, you’ll want the “Don’t have a Government Gateway account” option.

If it’s VAT you’re enrolling for, then it’ll almost certainly be “Organisation” you want here.

Should take you to this page. Fairly self explanatory, fill in some details for yourself, choose a password, and continue.

Next page includes your user ID. Ensure you jot this down somewhere (you should be emailed it too…but it’s important!)

Again, I’m assuming here you haven’t done any of this before, in which case “No” you haven’t already used a business tax account for your taxes.

Again, for this purpose we’ll assume it’s VAT you’re enrolling for. Of course you can do other taxes, but typically VAT’s an important one if you want to be able to submit your own VAT returns (either via the HMRC portal directly, or via third party software like FreeAgent).

Here you need to be a bit more specific…at this stage it’s just normal “VAT” that we want. UPDATE 10 May 2019 – we’ve been advised the styling from here on has changed, to be more in line with those above.

You may note the styling changes quite a bit here, as it reverts to HMRC’s more old fashioned styling. UPDATE – apparently this is no longer the case, so styling will continue similar to the above. Text should follow as per screen prints below. If your accountant has already done the VAT registration, then you want the bottom option. Ie you’re not trying to register for VAT all over again, you’re just trying to be able to do VAT related things for your existing VAT registration online.

This is perhaps the most daft part of the whole thing…but you once again need to tell HMRC that it’s VAT that you’re enrolling for. Don’t ask me why. Scroll down past lots of taxes (in alphabetical order), and again it’s the one just called “VAT” that you want here, with “Enrol for service” to the right.

Nearly there now, this is the page we were aiming for! Hopefully you’ll be able to answer the first three questions from info HMRC provided following the processing of the VAT registration. The bottom two ones will virtually always be “N/A” and “0.00”, because at this early stage your company hasn’t submitted a VAT return.

Following that you should just get a confirmation page. If the data is rejected, double check what you’ve entered for possible typos, or revert to your accountant.

Once this is done, you should immediately be able to submit a VAT return online. However you’ll need to wait perhaps a week for an activation code to be able to do more quirky things like change your company’s VAT details.

Why IR35 reforms moving to the private sector may be positive

Going against the grain, but bear with me on this…I think there are some very real positives if this goes ahead. Ie current expectations that April 2017 changes to public sector IR35 operation start to apply to the private sector at some point (possibly from April 2019) too.

Motives more aligned with the client

An issue with current IR35 enquiries, is that the end client typically has no real interest in it. They don’t care either way, as they have nothing to gain or lose. They may inadvertently say something that “drops the contractor in it”, eg when describing working practices.

Also, long before it gets to that stage, they’re not overly bothered in ensuring the contract or working practices are IR35 friendly. So you have one party wanting it to be outside (you), one party wanting it to be inside (HMRC), and a largely independent client that could help or hinder the arguments of either party.

This would all change if the end client became responsible for the decision, and surely this is a positive thing for the contractor. Going forwards the end client is more likely to work with the contractor, against HMRC, two vs one. Where the end client has something to lose, they’re going to take far more care ensuring contracts and working practices are IR35 friendly, and that they don’t say something daft in an enquiry.

More time, less of a surprise

The public sector had these rule changes thrust on them with very short notice. Nobody knew how to react. This lead to a knee jerk reaction with many (slightly irrationally, and incorrectly) deciding every single contract was inside IR35.

This won’t be the case with the private sector. They’ll have time to:

– carefully consider their options,

– liaise with legal experts around contracts/working practices,

– liaise with insurers and come up with a package for in case HMRC disagree,

– liaise with contractors about how best to proceed.

The private sector won’t be ambushed in a surprise attack like the public sector was.

Risk completely taken away from the contractor

Whilst many contractors wouldn’t like the higher taxes of being inside IR35, for many it’s the not knowing that’s the worst thing. They can trade happily for years, paying what they think is the correct taxes as they believe they’re outside, then way down the line HMRC raise an enquiry. If that goes against the contractor, they can suddenly have to find huge amounts of extra taxes to pay HMRC, from money they’ve already spent.

There are insurers who currently offer to cover some/all of the extra taxes…but going forwards it simply won’t be a risk on the contractor at all. You can sleep soundly, knowing that if things were wrong, it’s the end client that would potentially lose out, not you.

The “losers”

Yes, there will be some contractors who previously treated themselves as outside IR35 (rightly or wrongly), and will now find their clients insisting they’re inside IR35. They would lose out financially, suffering the higher taxes of an employee. Many will then give up their companies and either operate via an umbrella, or as permanent PAYE employees. However, I believe the numbers of these may be more modest than some doom-mongers are predicting. Also these will likely be the type of workers that annoy those who consider themselves “proper contractors”, and realistically if ever challenged on their old practices would have likely failed an IR35 enquiry anyway.

End result

Hopefully the modest number of those “losers” above will be sufficient to make HMRC relatively happy that they’ve “won”, even though I imagine they’ll be disappointed at how low that number is. They’ve then also made it harder for them to challenge other cases as now the clients have motives nicely aligned with the contractor. Plus it would be big corporates with highly paid solicitors they were challenging, rather than the little guy.

End clients will drift towards having two tiers of contractors. Those who are outside IR35, and those who operate via an umbrella or are encouraged to go onto the payroll. The client will need to make sure any in between are shuffled one way or the other and treated appropriately. Everyone will know where they stand, and things will settle into a new equilibrium.

If HMRC do proceed to roll out the same rules to the private sector, will it be far worse than I’m making out? Interested in hearing other people’s views.

Layman guide to confirmation statement and persons of significant control for micro companies

The Companies House “annual return” is no more. Instead we have the “confirmation statement”. In many ways it’s similar to what it replaced…so what’s changed?

Persons of significant control (PSC)

There’s lots of big sentences with long words which make this sound much harder than it actually is. Oversimplifying a little, a PSC is anyone with >25% share ownership in your company.

First thing to say – shareholders aren’t always humans. I mention this as it’s largely why this section looks complicated. Shareholders can be either a human being, a corporate body (eg Ltd Co) or what’s known as a “legal person”. For your typical micro business, it’ll be the first option, “a person with significant control”.

Adding a PSC

We’re adding our first person. There are quite a few basic details requested. There is an option to protect the identity of PSCs from the public record. Reality is the vast majority of business owners won’t be able to do this.

It then asks for your date of birth. As with details for directors, only the month and year will be publicly available (to go some way towards making life harder for potential ID fraudsters). It also requests Nationality.

Correspondence address – this will be publicly available. If you’re concerned about data privacy, you may want to make this somewhere other than your home address. Having said that, the majority of small Ltd Co owners will use their home address for this.

Home address – your actual home address is separately requested. This won’t be publicly available. Your country of residence will be publicly available.

Nature of control

This is where again it can look more complicated than it really is.

Ownership of shares –> The person holds shares, then choose relevant %. Note that if the person owns exactly 25%, 50%, or 75% they fit into the lower category (ie 50% exactly is “more than 25% but not more than 50% shares”, it’s not “more than 50% but not more than 75% of shares”).

Ownership of voting rights –> The person holds voting rights. Unless you’ve got a fancy share structure where only some shares hold voting rights (wouldn’t recommend this for a simple micro company) then this will exactly mirror the shares.

Right to appoint or remove the majority of the board of directors. As suggested earlier assuming it’s a human shareholder, the 2nd and 3rd options aren’t relevant. It’s just whether the 1st is true or not. In practice anyone controlling the company (ie >50% shares) can appoint or remove directors. For micro companies the directors and shareholders are likely to be the same people (or spouses/similar), so this is more a technicality to put on the form rather than something you need to be concerned about.

Has significant influence or control. (updated 24 Nov 2016) it seems if any of the above boxes have been ticked, this now needs to be left blank. If you do tick the top option whilst also confirming that the individual holds shares/voting rights etc, the Cos Hse form seems to give an error message. Simply leave this one blank. We think it’s only relevant if none of the above more specific reasons apply.

When did this person become a PSC?

Logic might suggest it would either be the date of incorporation, or if it’s someone who only received shares later than that date, the date they went over 25% share ownership. However, the form will only accept a date on/after 6 April 2016.

I’d therefore suggest you choose 6 April 2016, unless you only obtained your shares after that date.

Rest of form

After that, the rest of the confirmation statement is no different to the annual return. Check the registered office address is still valid and shareholders match, but otherwise typically just a case of clicking confirm/next half a dozen times then paying a £13 fee to Companies House.

Unpaid share capital – something that confuses a few people. Just enter £0 here, on the basis you will have paid for your share (if not physically putting the £1 or £100 in, it’ll likely have been dealt with via director loan account.

Shortened deadline

Oh…and whilst you had 28 days to file the annual return, you have just 14 days to file the confirmation statement. Having said that, there was no financial penalty for late filing of an annual return, and the same seems to be true for the confirmation statement. As with the annual return though, if left too long Companies House will start threatening striking off action.

Changes to tax on MVLs overstated

Following the Autumn statement there’s a consultation document about taxation of distributions from members voluntary liquidations (MVLs), amongst other things. Google something like “HMRC liquidation consultation document 7029” to see the full PDF…though be warned in typical HMRC style despite covering a fairly small topic it’s a hefty 19 page PDF.

From some of the marketing I’ve seen from liquidators and accountants alike, I believe the impact of these changes is being massively overstated. This may simply be a questionable marketing tactic from the liquidators specifically, “buy now or miss out forever”, with the truth being considered unimportant…but I appreciate many of you will be aware I’m partly behind MVL Online so may consider myself being biased. I like to think not, though it does mean I’ve taken more of an interest in these tax changes than many accountants might.

So, what is actually changing?

Basically the already existing anti avoidance legislation transactions in securities is being beefed up a bit. It attempts to prevent people continuing to trade whilst still getting cash out under the normally friendly capital gains tax (CGT) rules.

Old/existing rules

There already is anti avoidance legislation in place to prevent the above scenario, but it’s fair to say a lot is left open to interpretation, with little in the way of clear cut black and white rules to check whether you’d be caught. This legislation is able to look through any liquidation if they successfully argue the underlying trade continued. Ie someone transferred the trade and assets (except hefty cash balance) from Oldco to Newco, then liquidated Oldco to get the cash out tax efficiently. If so, they’ll tax the distributions as dividends rather than via CGT.

One of the main problems from a clarity perspective is that it was left very unclear as to where the line would be drawn between a trade continuing just with someone taking a brief holiday, vs the old trade properly ceasing and a new trade starting. People threw around various timescales for this, from a couple of weeks, to multiple years…but reality is we were all guessing how HMRC might interpret it, and perhaps more importantly how a judge might if it went to tribunal.

New rules

The new rules (still under consultation at time of writing) have set a clear cut two year timescale on this. Ie if you liquidate today and set up a new company doing a similar thing in 18 months time, be warned you could see those liquidation distributions taxed on you as dividends rather than capital gains.

One other thing that’s been clarified is that the business type doesn’t need to be the same. This unfortunately (though probably deliberately) means it will catch those looking to disincorporate following the new dividend tax. By this I mean close down their Ltd Co and instead start again as a sole trader/partnership.

The three conditions to be caught

Distributions as part of a liquidation normally taxed via CGT would instead be taxed as dividends if all the following conditions are met:

- Condition A – An individual who is a shareholder in a close company receives from it a distribution in respect of shares in a winding-up;

- Condition B – Within a period of two years after the winding-up S continues to be involved in a similar trade or activity; and

- Condition C – The arrangements have a main purpose, or one of the main purposes, of obtaining a tax advantage.

A will realistically apply to the vast majority of the situations I’m thinking of, being a small owner managed company that’s cash rich, coming to an end and being liquidated.

B is open to interpretation as to exactly what counts as “a similar trade or activity”. In particular see bit about PAYE further down.

C again is a little unclear. There may be many reasons for liquidating a company, but cynic in me thinks where the tax treatment is beneficial when compared to dividends, it’s likely HMRC could argue this point does apply regardless of what other genuine motives there may have been.

So should I be scared?

If you plan to use an MVL to get cash out tax efficiently then immediately restart a new business doing exactly the same thing, then yes! In fact you should be caught under the existing rules.

If you have no intention of restarting, then no! If you’re liquidating your company for reasons such as:

– emigrating,

– retiring,

– doing something completely different,

then it doesn’t matter whether you’ll be getting lots of cash out upon liquidation at a nice, friendly tax rate. You’ll be fine whether you liquidate before or after 5 April 2016.

Do take a bit of care that despite your intentions at point of liquidation, if circumstances change and you get an opportunity to go back to what you were doing before within 2 years, you could be at risk. Arguably this is the only thing that is changing in practice.

There’s also suggestion that the new rules are likely to make MVLs less appealing, at least from a tax perspective, for property special purpose vehicles (SPVs). Many property developers choose to regularly liquidate and restart a clean company. Sure, tax can be one reason, but another key one is limiting liability. Ignoring any ethical/moral question, this can be a good idea. You do a large piece of building work, the client’s happy and pays, you then liquidate. If a year down the line a problem crops up with the property, the legal entity which did the work no longer exists so the customer has little come back against the builder. Outside the scope of this post, but I believe there are various unions/trade bodies which help the customer in these circumstances…but for the purpose of this post, there’s a reasonable chance that any tax benefits of this tactic will be removed, as most property developers would be on the next project within 2 years.

What about a PAYE job in a similar field?

If you’d asked me a week ago I’d assume you’d be 100% safe. The consultation talks about doing a similar “trade or activity”. My understanding was that “activity” was included so as to catch investment businesses as well as trading ones. However, it seems some believe that it could include someone reverting to PAYE employment in a similar industry too (eg a contractor taking on a permie/umbrella role in the same field).

Another accountant who queried this with the person behind the consultation was told:

(you ask)”whether ‘trade or activity’ includes being in employment. I think that employment will count as carrying on the same or a similar trade or activity. However, as with my comments above, meeting Condition B does not in itself mean that the legislation will apply. Where a person ends their own business and liquidates a company, and goes on to act as an employee for an unconnected third party, it would seem unlikely that Condition C would be met”.

As per my own thoughts on Condition C, I take little comfort in his closing comments, as I think HMRC could easily change their view on this. I’ve therefore written to the author asking for the rules to confirm that things like PAYE employment would specifically not be at risk (whether he takes any notice is another matter of course). Last thing I think anyone wants is further uncertainty in the tax world.

18/01/2016 – uninteresting update – Adrian Coates has responded to my consultation comments…but only to say he’ll consider my views together with others.

Summary

Getting an MVL of a redundant, cash rich company will still be a viable, tax efficient method of extracting cash. You just need to be careful to ensure you do something very different for at least two years following the liquidation.

UPDATE 9 AUGUST 2016

Whilst still not much is set in stone, it seems HMRC have been sending out a standard response to anyone requesting clearance (ie conformation in advance that their situation wouldn’t be caught) regarding this. See the below PDF:

Distributions in a winding up_Clearance requests

Most significant bit to my mind is last sentence of 1st para on 2nd page:

“Condition C will not be met where the individual is employed by an unconnected third party.”

So situation some people were concerned about is Joe Bloggs does IT development work on a contract basis through Joe Bloggs Ltd. He then liquidates (with a tidy cash balance) to become an employee doing IT development work for big corp. Seems crystal clear HMRC are saying they will NOT attack this situation.

Also of interest (to me at least!) are examples 1 & 3. Both seem to me to be situations the legislation if read broadly could easily be attacked by HMRC.

Eg example 1 – someone running a Ltd Co semi retires, liquidating, but then does the same thing as a sole trader. I imagine in this case the turnover of the sole trader business would be quite a bit lower than the Ltd Co before it…but still, seems surprising to me HMRC saying this wouldn’t be caught. I wonder where the line would be drawn, eg if the sole trader business was just as big as the Ltd Co, presumably HMRC wouldn’t be so happy. Perhaps this example adds more confusion on where boundaries are rather than clarity…but still, it suggests HMRC won’t be too aggressive regarding this anti avoidance rule.

Do I charge VAT when selling services to overseas client?

It’s another “write an answer to a question we get asked a LOT” blog post. This post includes a lot of what NOT to do, covering some of the most common mistakes people make.

It’s becoming increasingly common for even micro UK businesses to have clients outside the UK. For the purposes of this post I’ll be talking about sales of:

– services rather than physical products,

– NOT “digital services” for the purposes of VAT MOSS (ie bespoke work you’re doing, rather than selling a “make once sell many” eBook/app/similar),

– sales that are B2B rather than B2C (ie you’re selling to an overseas established business, rather than an end consumer),

– from a UK supplier to an international customer.

The key thing that can get complicated is where is the place of supply deemed to be, and the above are key in making that decision. Where all the above apply, the place of supply is deemed to be where the customer is based (hence not in the UK), so no UK VAT should be charged.

Very brief outside scope vs exempt/zero rated

It’s also important that these sales are outside the scope of UK VAT, rather than being a sale that’s zero rated or exempt from UK VAT. If you think this sounds pedantic, it certainly isn’t if you’re on the flat rate scheme, as your FRS % isn’t chargeable on outside the scope sales, but is chargeable on zero rated/exempt sales (despite no VAT being charged).

How to deal with this correctly on FreeAgent

The key section is “Contacts“. I appreciate some of you only use this for client name for your own internal purposes and nothing more, but this is one situation where completing at least a little more information is compulsory.

Key things are:

1) Ensure you change the country drop down from its default United Kingdom to the appropriate country. This is NOT just for show.

2) Check the setting slightly further down. This will default to what’s normally the correct setting, but where you’re selling services internationally, B2B, you want it to show “Charge VAT – Only if contact is also based in the United Kingdom VAT area“.

With those settings as above, when you then go on to raise a sales invoice to that client from the “Work” –> “Invoicing” section of FreeAgent, it should correctly be treated as outside the scope of VAT.

This means not only will you not charge VAT to your client, but the sale won’t appear at all on your (UK) VAT return.

Extra possible quirks

A few extra things to consider:

- EC sales lists – no additional tax is at stake, but where you sell services to EC countries, you’ll likely need to start submitting EC sales lists. These are relatively straight forward and can be submitted online, they’re basically just a summary of your European customers, their country, their local VAT number, and total value of your sales to them.

- B2C sales – if your client is an end consumer, but you’re still selling a bespoke service internationally, then you should change the “Charge VAT” setting to “Always”. Reason being for B2C sales typically the place of supply is deemed to be where the supplier is based (rather than customer), hence sales are deemed to happen in the UK.

- Sales of “digital services” – the B2C sales rule above was to some extent abused by the likes of Amazon who were able to set up shop in low VAT countries like Luxembourg, so if a UK consumer wanted to buy an ebook, they’d pay 15% VAT to Amazon, or 20% VAT to a UK supplier, hence giving Amazon an unfair advantage as taxes made their prices lower than local competition. Therefore new rules were introduced from 1 Jan 2015 called VAT MOSS (or VAT Mini One Stop Shop). These meant where you’re selling “digital services” (this would be most things where you create it once then can re-sell an identical item lots of times, eg ebooks, apps, music/video etc) to an EU consumer, you need to charge VAT based on where your customer is. This is a bit of an admin nightmare for micro businesses, as you need your online shop to be set up to gather various bits of information from your client and charge their local VAT rate accordingly…then send this info on once a quarter, together with payment of international VAT. This is a complex area so no great detail gone into here.

- Sales of physical products – this very rarely applies to our typical client base, so again I won’t go into details here.

Where should I allocate the annual return fee on FreeAgent?

Shortest blog post ever…but answers a question we get asked a LOT.

Q – Which category should I put my £13 annual return fee to on FreeAgent?

A – It doesn’t really matter which category you put it to. Sundries, accountancy fees, legal & professional, all are equally correct.

Key thing is ensure you override FreeAgent’s “Auto VAT” to “0%” as there’s no VAT on Companies House fees.

Why I hate webinars

What is it about webinars that seemingly makes them the new “must use” thing? They’re rubbish, and here’s why:

Start time

For TV programmes/films, those in power are increasingly realising people don’t want to have to schedule their lives around their favourite programmes. We want to be able to watch them when we can, fit the programme around our life rather than the other way around. Hence the success of things like Netflix and iPlayer.

The internet has had this ability for ages. Youtube is over a decade old. You can watch a video whenever you want, regardless of what other people are doing.

Webinars are a massive step backwards from this perspective. You need to book it into your calendar, plan your work/fun activities around it…and hope nothing unexpected/important crops up last minute, as otherwise tough, you’ll miss the webinar.

Technology

Yes, the technology is there for webinars to work…but you can guarantee at least a quarter of people meant to be on a given webinar will have tech difficulties. These will inevitably only be discovered last minute, so whilst you’re ready and waiting bang on the start time, nothing happens for the first 10 minutes as someone has to install a bunch of software updates.

It’s like conference calls. Phones, whilst getting ever more sophisticated at many things, are seemingly becoming continually worse at actually making/receiving calls. It can be hard with just two people, but add in a few more and there will be a problem, wasting everyone’s time.

Other people(!)

So, there’s a webinar, where you did remember when it was on, nothing unexpected cropped up last minute, you do log in, and (eventually) all the other users manage to get it working. Great.

Next thing is after the absolute simplest statement from one of the people hosting it, someone asks a question that’s of no interest to you. The main focus of the webinar gets sidetracked as it drifts off on a tangent that perhaps just one person wants it to take, frustrating everybody else.

This will likely repeat multiple times over the course of the webinar, often meaning the key thing that you actually wanted to learn about never comes up, as sod’s law it’ll have been 3/4 into the planned timeslot, but stuff over-ran early on meaning it gets left off.

Timing

All of the above issues are either directly or indirectly about timing…but there’s one other timing feature not covered by the above. In a video, you can fast forward the dull bits/bits you don’t need help with. You can also slow down/replay the bits that interested you/you struggle with. You can do all this without impacting others…as of course it won’t always be the case that everyone finds the same bit interesting/hard.

So…why do big businesses and public sector organisations insist on using them all the time? Please, just release a video instead. The world will be a better place.

What Corbyn can teach small businesses

There seemed to be lots of surprise about Jeremy Corbyn winning the Labour leadership by a landslide. What happened, and what can we learn from it?

Out of the four candidates, Corbyn had very strong views, many of which differed from what’s currently “the norm” in politics (though some will say they were the norm 35-40 years ago, and failed). This made him a bit of a Marmite character, you either think he’s brilliant or an idiot.

The other three…well, to the masses, nobody really understood what any of them stood for, or what they’d do differently to the Tories/Ed Milliband. Quite possibly that’s because the current system is generally very good, so doing nothing beyond minor tweaks is the best route forwards, but that hardly makes you exciting to vote for.

I won’t go into the specific politics involved as it’s outside the scope of this post and I’m not clever enough. However there’s two relevant things as far as I’m concerned:

- Corbyn got 59.5% of the vote, three times as many as second place, with just 19%. This despite many considering (rightly or wrongly) his opponents were far more credible candidates.

- If you believe many pundits, under Corbyn Labour will never get into power, as whilst he might appeal greatly to a minority, he won’t be able to convince the majority (ie inc Tory voters). There’s concern Labour could become a minor party, fighting for stuff which only a small section of the population want.

Now, if you’re Amazon, or Tesco, the second point is significant. To appeal to the masses, you need to take great care not to alienate too many people.

However, 99.99% of us don’t run a business anything like Amazon or Tesco. We run tiny businesses, which even in a small niche will unlikely ever cater to more than 10% of the market we’re in…more likely a fraction of 1%. Therefore I think we can learn a great deal from Corbyn’s success (or indeed the rise of UKIP/The Greens/SNP in the 2015 general election).

Corbyn’s recent popularity proves it’s seeing something different that people want. Also having a clear message of what you stand for. Being asked to vote between seemingly identical candidates or parties (who could really distinguish between Labour/Tory proposed policies last election?), it’s no wonder voter numbers go down.

In politics, the first past the post system means minority parties need to do REALLY well to actually achieve anything. In the small business world, thankfully, there is nothing like the first past the post system. Great success can be achieved from only catering to a small section of any market.

So what does this mean for you?

- if you want people to be interested in what you do rather than the competition, make sure you’re actually different to your competitors, and be clear about what you offer/stand for. If you’re just another [accountant/web designer/whatever], no different to all the others, why would anyone be interested.

- as small business doesn’t have any kind of first past the post system, only appealing to a small part of the total audience is absolutely fine. Find a niche you’re passionate about/an expert in. Far better to really appeal to some of the market, than have the entire market ignore you as nothing special.

In the small business world, be like the minor parties. Find a niche sector of the market that’s not getting much focus from the big boys and hammer home how you can help.