RTI filing deadlines are causing confusion for a lot people (like everything HMRC related!)

RTI is very different to every other tax in terms of deadlines. VAT, corporation tax, self assessment, for all of those you wait until the period ends, and then have a certain amount of time after the end date to file the return. RTI is different, giving you much less slack.

Basic rule (that you can realistically ignore)

The basic rule is you need to submit your payroll information to HMRC for any given period on or before the date staff are paid. For the purposes of this blog, and as FreeAgent doesn’t support weekly pay, we’re only going to discuss monthly payrolls.

BUT…HMRC have no idea when you physically pay your staff, as they don’t have direct access to your bank statements (thank goodness). So how do they know?

Let’s ignore what the rules say for the time being, and look at the information HMRC actually do know/find out when you submit:

– the date the payroll is said to occur. In theory this should be the date the payroll is paid (but in reality it might not be).

– the date you actually clicked the buttons to submit the payroll.

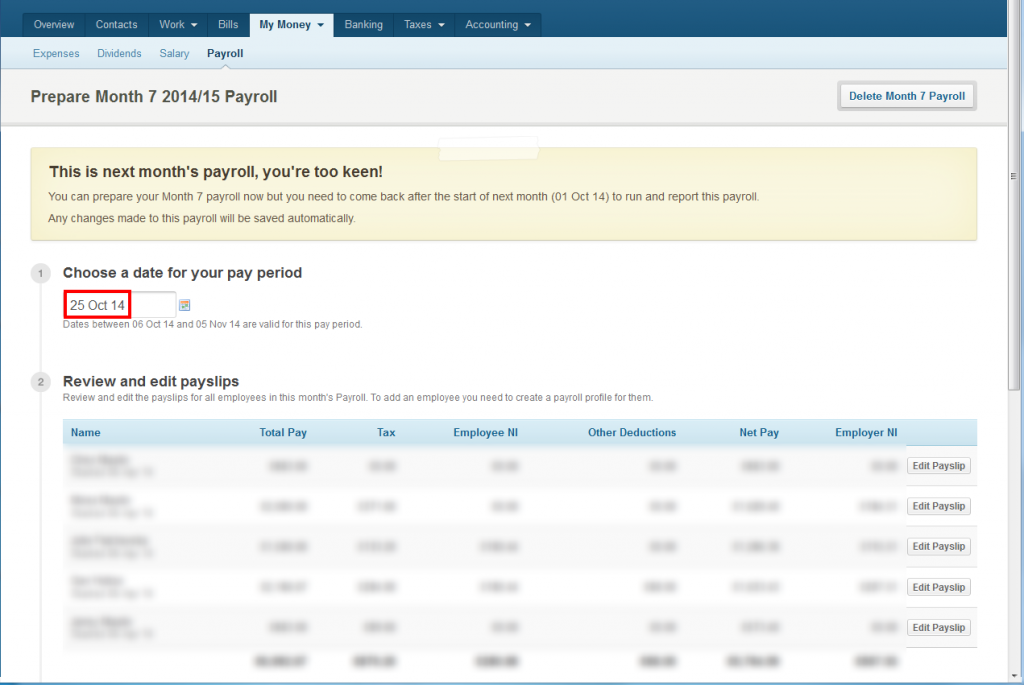

Above is a screen print (with sensitive data blurred) of a month 7 payroll period (October), as drafted on 11 September 2014.

Key thing I want to flag is the date highlighted in red. In this example, 25 Oct 2014. That date is to some extent editable, but whatever is chosen for it becomes the filing deadline. It needs to be a date between 6 Oct 14 and 5 Nov 14. FreeAgent defaults to 25th of each month, and I see no good reason to change this consistently, it’s as good a date as any.

This business is a bit ahead of themselves, month 6 was submitted early (deadline for it would have been 25 Sep, it was submitted 9 Sep), but that’s fine, no harm in submitting early.

What are the default FreeAgent filing deadlines?

As FreeAgent defaults to set the payroll date to 25th of the month, that is also the filing deadline, so:

Month 1 – 25 April

Month 2 – 25 May

Month 3 – 25 June

Month 4 – 25 July

Month 5 – 25 August

Month 6 – 25 September

Month 7 – 25 October

Month 8 – 25 November

Month 9 – 25 December

Month 10 – 25 January

Month 11 – 25 February

Month 12 – 25 March

What if I only notice on 26th of the month that I haven’t submitted the payroll for that month? Well, you can be cheeky, and edit the date, putting it back a day, then submit (so it’s on time). Not really recommended, and of course there’s only a small window that this is physically possible anyway (absolute latest 5th of the month afterwards). Plus, for the time being there’s no penalty for late submissions.

Why don’t I set it to 5th of the month after to give me maximum time to file? Theoretically you can…but I wouldn’t recommend it. People tend to find having a payroll date of 1st-5th the month confusing. Reason being it means for profit and loss purposes the payroll is in a different month to for payroll purposes. Eg take a company with a year end of 31 March. If they ran their payroll dated 5th of the month, then “Month 12” payroll would be processed 5th April, making it in the year after the year it realistically related to.

HMRC have recently agreed to delay the introduction of late filing penalties for companies with <50 employees until March 2015. Therefore, at present, even if you’re late (as many companies have been multiple times), there’s no penalty. Be aware this will change, it was going to be from October 2014, but due to teething problems all round, small companies have another 6 months respite.

If an RTI return is submitted late, FreeAgent will ask you for the reason. The options are:

– No other reason applies

– Notional payment: Payment to Expat by third party or overseas employer

– Notional payment: Employment related security

– Notional payment: Other- Payment subject to Class 1 NICs but P11D/P9D for tax

– Micro Employer using temporary “on or before” relaxation

– No requirement to maintain a Deduction Working Sheet or impractical to report work on the day

– Reasonable excuse

– Correction to earlier submission

Reality is most of those are “big boy” only things where there are complex issues at play. The main one most FreeAgent users are realistically going to use will be “No other reason applies”.

If the real reason is “I forgot”, this does not count as a “Reasonable excuse”. Neither does your hamster dying or you having man-flu on the submission date.

So realistically, what should I do to stay on top of things? I’d recommend setting a monthly recurring reminder in your calendar, perhaps dated 6th of each month, to submit the month’s payroll. Yes, it’ll be almost 3 weeks early, but better that than doing the reminder for 25th, then if you’re on holiday that week, or it’s a Saturday you’ve got to mess around with dates or accept it’s late.

In terms of when can you physically pay the salary, to stay on the right side of the law, I’d recommend always paying yourself a bit to late rather than early. Realistically HMRC won’t know when you transfer the funds unless they do an enquiry and demand the information (highly unlikely), but better to be safe than sorry.

Any queries/comments, feel free to post below.