As in previous years we’ll set out the most common optimum, then end with a few exceptions. There are negligible significant changes between 2018/19 and 2019/20, mainly just inflationary increases to most thresholds. Just to clarify the below are suggestions in for the tax year starting from 6 April 2019.

The “most common” situation:

For one person companies in 2019/20, we recommend a salary of £719/month. This replaces £702/month for 2018/19. It’s the maximum before NICs actually become payable, yet is still sufficient to count as a contributing year towards basic state pension.

On the basis of that salary (so £8,628 for the year) and no other personal income, you can take dividends of:

– £5,872 and suffer no personal tax (0%)

– £41,372 (ie an extra £35,500) and suffer £2,662.50 personal tax (£35,500 at 7.5%)

– £91,372 (ie an extra £50,000) and suffer £18,912.50 personal tax (the above £2,662.50, plus £50,000 at 32.5%)

The above thresholds are not hard limits, just the levels above which the marginal rate of tax increases (ie the amount of tax suffered on each extra £ of dividend taken). Above the top limit you start to lose your personal allowance so the effective tax rate becomes increasingly penal.

Exceptions:

– 2+ staff – for those with 2+ people on the payroll but overall very modest salaries (so £3k employment allowance won’t be fully utilised) and preferring tax savings over simplicity, you may choose to opt for the slightly higher salary of £1,041/month (equivalent of £987/month for 2018/19). This will incur employee NICs, but still no PAYE as under the personal allowance, and the employment allowance will negate the employer NICs. In practice this will save a couple of hundred quid over the year, but be aware staff net pay won’t consistently equal their gross pay, so there will be deductions to pay over to HMRC. Please also note this extra £3,864 salary over the year impacts on the dividend thresholds, so basically £2k tax free, £35.5k basic rate (£37.5k total dividends), £50,000 higher rate (£87,500 total dividends). If in doubt, just go for the lower £719/month, it costs negligibly more and avoids complications.

– Student loans/higher income child benefit charge – these aren’t really exceptions as such, but things to be aware of that can increase what you have to pay. If you have an outstanding student loan or claim child benefit, and your total overall income is above £21,000 or £50,000 respectively, then there will be additional charges of loan repayments and/or having child benefit clawed back.

If you don’t want to be overly concerned with the precise details, then the general logic isn’t surprising. In the vast majority of situations, as personal income goes up, the tax rate goes up.

Also, don’t be concerned about possibly dribbling just above a threshold. If for example you went £10 into the higher rate band, it just means that top £10 of your income would suffer 32.5% instead of 7.5%. There’s no sudden sting for going pennies above a threshold.

Category Archives: FreeAgent tips

How to enrol for MTD

The first compulsory MTD submissions are for VAT quarters starting 1 April 2019. So unless you’ve got a shortened quarter for some reason, quarters ending 30 June 2019 and onwards. This post should help you with the sign up process.

Overview of what needs doing

We will assume for this purpose that you already use MTD ready software (eg FreeAgent) for your bookkeeping. If you don’t, you’ve got a much bigger upheaval, as you may well need to change how you do your bookkeeping. Discuss with your accountant if you’re unsure.

On the basis you are using MTD ready software, the hassle is modest, and change other than short term tweaks is trivial. For the time being at least, only the numbers in the VAT boxes are submitted, and only when you click the button to submit. However behind the scenes it’s being transmitted in a different way. Prior to MTD, data is submitted as/when instigated by you, with you needing to add your HMRC Gateway ID details each time, as they’ll go with the submission to show it’s from you. Post MTD, you’ll be setting up a permanent link between your bookkeeping software and HMRC portal. So when you come to submit data, it will be quicker and you won’t have to re-enter ID/password, as it’s not revalidating anything.

Steps below:

1) Make the required tweaks to your HMRC portal account. It’s critical this step is done before any changes to your bookkeeping software. Reason being the HMRC side is the tricky bit (more down to their poor UX than anything else), and all sides need to be aligned. Ie if you tweak your FreeAgent account to opt for MTD, then struggle with the HMRC side, you’ve got a problem. Given how unfriendly the HMRC side can be, we’ve got a step by step “what to click where” guide further down.

2) There’s a button that either user or accountant can change on FreeAgent to switch the account over to MTD. I believe this is hard/impossible to reverse…so do step (1) first!

3) This will add a new settings menu to FreeAgent (NB typically your accountant cannot see/alter this bit), where you need to link FreeAgent up with your portal. Ie tell FreeAgent your HMRC gateway ID and password.

4) You’re done! Next time you go to submit a VAT return, it will look slightly different, but you’ll barely notice.

HMRC portal step by step

If there is a painful bit, it’s this. We’ve run through it recently and taken screen prints of every step. Unfortunately HMRC are constantly tweaking things, so inevitably it won’t be long until the process deviates slightly from what’s below, but hopefully you can follow it easily enough!

Your HMRC portal account must already be enrolled for online VAT services. If you’re unsure what I mean by this, you’ve got some more basic bits to deal with first, discuss with your accountant.

From here we’ve used red text for our comments to help them stand out from text in the many screen prints.

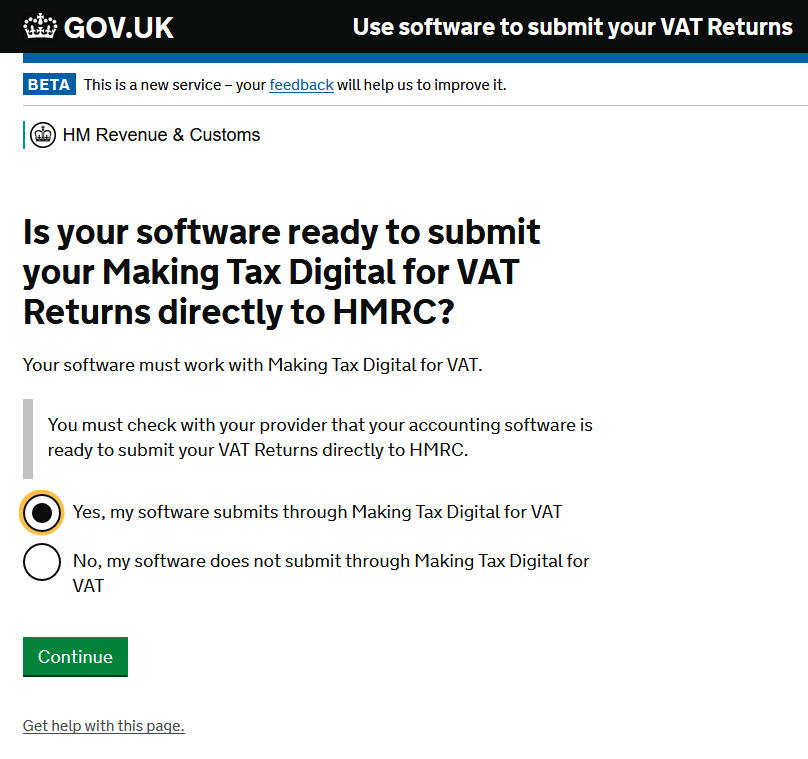

1) URL to start is https://www.tax.service.gov.uk/vat-through-software/sign-up/have-software

2) Yes you have suitable accounting software (assuming you already use FreeAgent/equivalent):

3) …and yes, FreeAgent is ready for MTD:

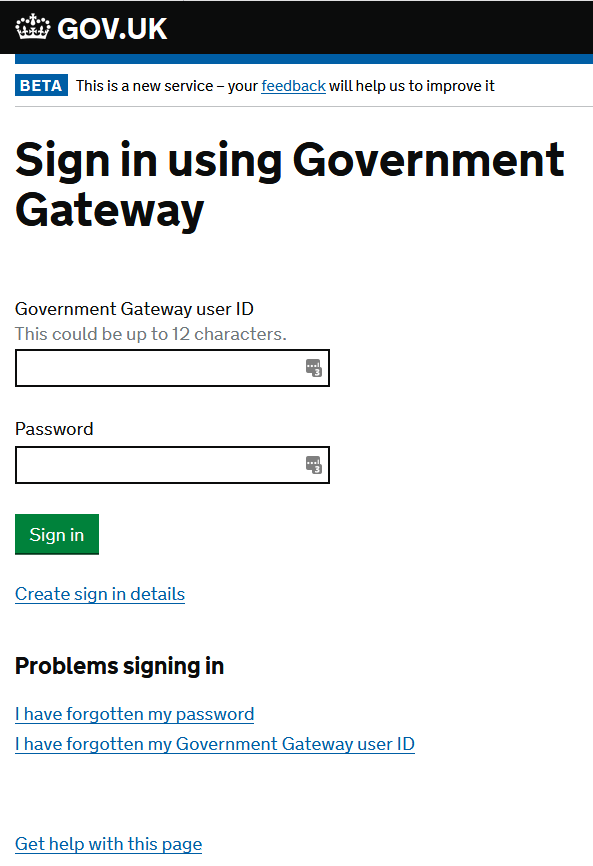

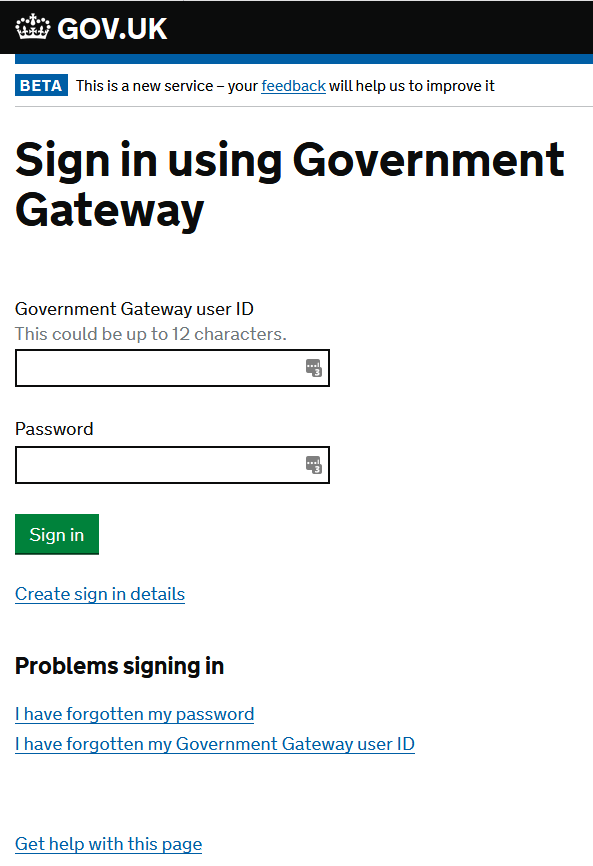

4) Enter your gateway ID and password (hopefully you know these!). NB after entering these you may have to enter an access code/be suggested you set up security back up etc depending upon the settings in your account:

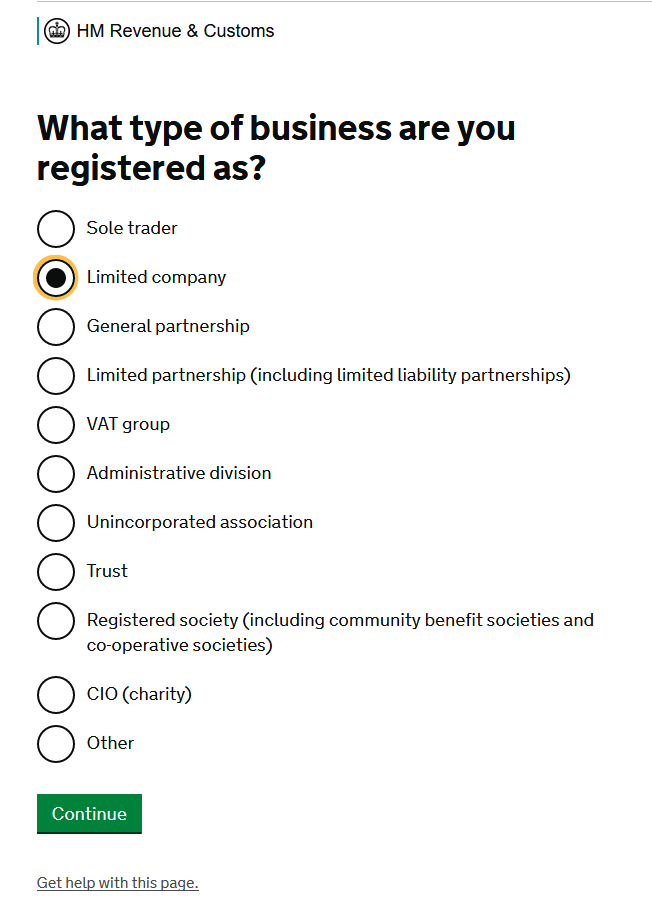

5) We’ll assume for this purpose you just have one business(!)

6) …and it’s a Ltd Co:

7) Enter your Cos Hse registration number (if you’re unsure, either ask your accountant or search for your company name from https://beta.companieshouse.gov.uk/):

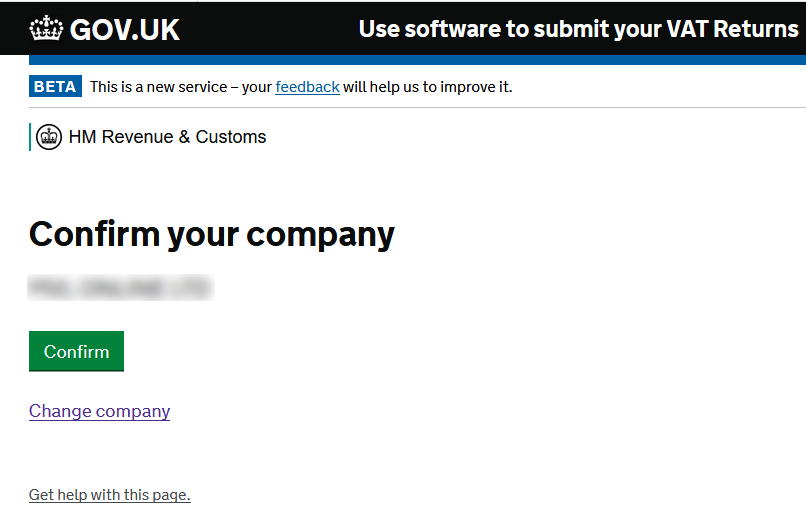

8) …and confirm it’s the right one:

9) What is your company’s Unique Taxpyer Reference number? (sometimes referred to as your corporation tax UTR, your accountant should know if you’re unsure):

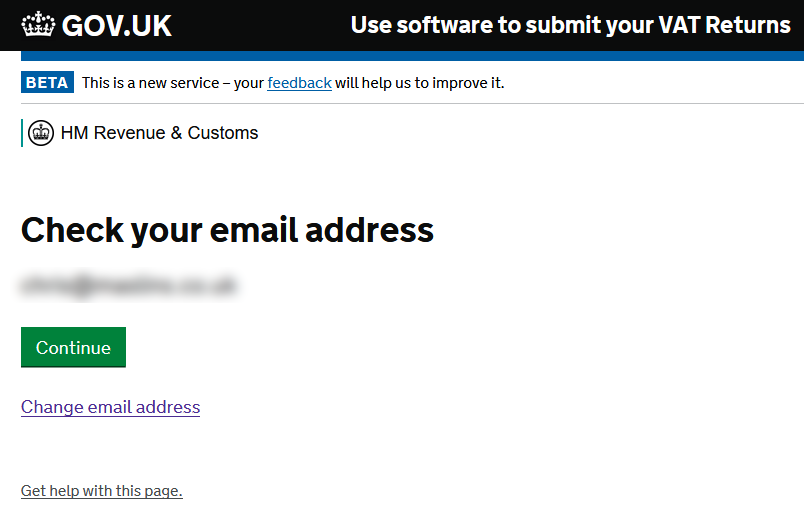

10) What’s your email address:

11) Check email address for typos:

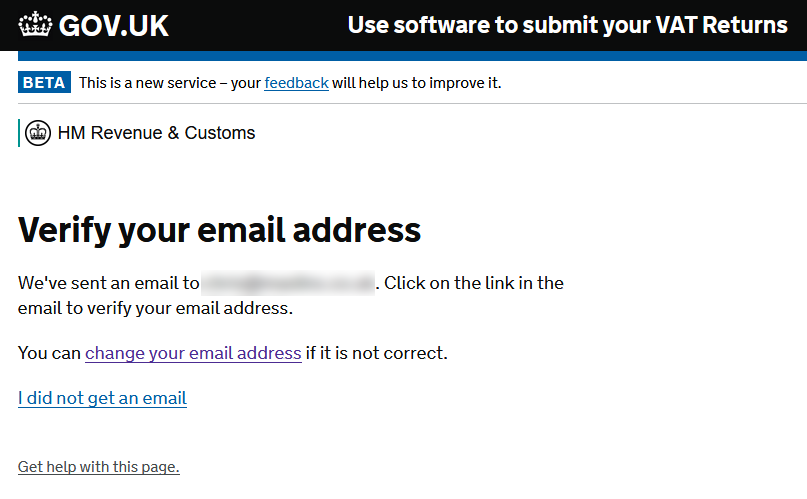

12) Verify email address:

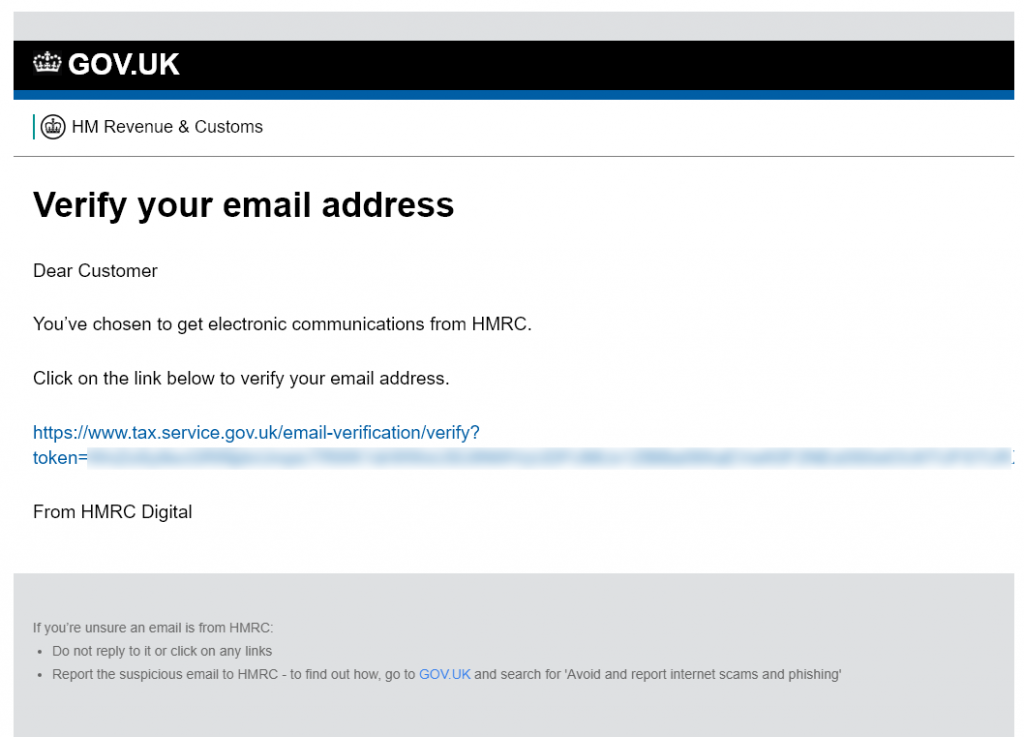

13) NB this next one is from an email received, not following the webpage:

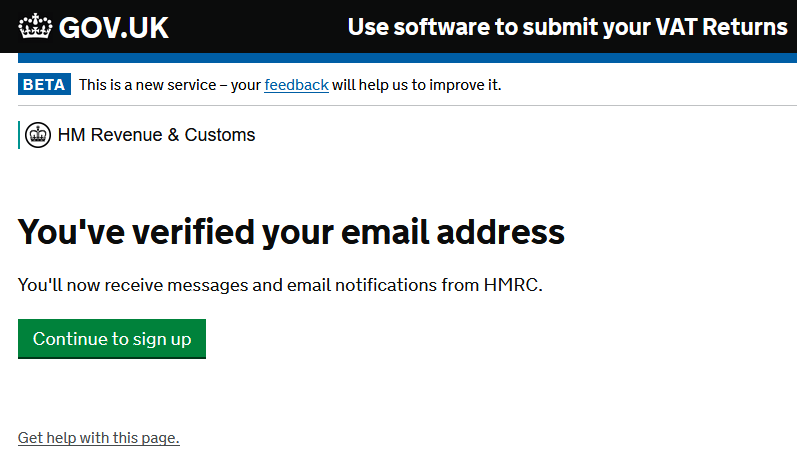

14) Email verified:

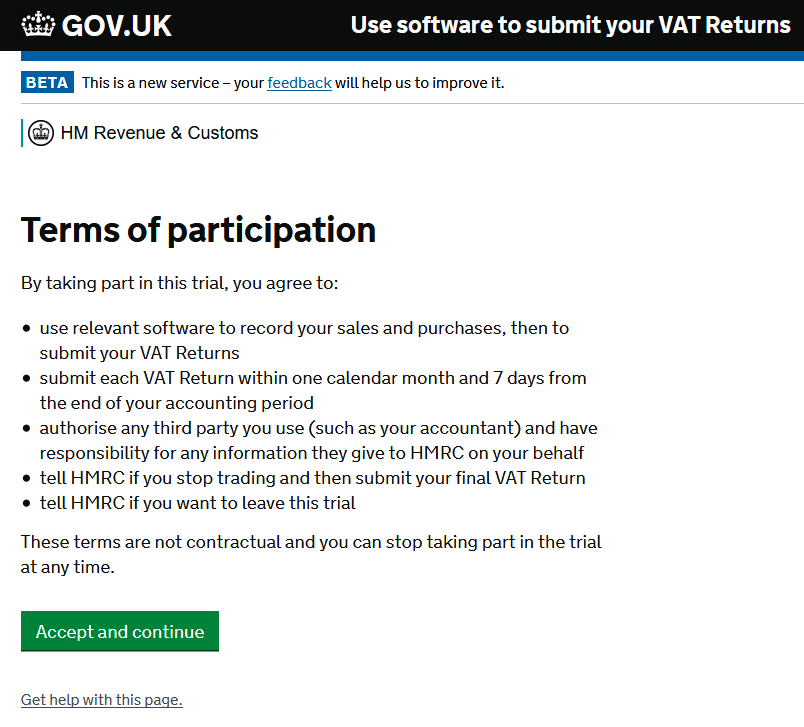

15) You sure you know what you’re letting yourself in for(!):

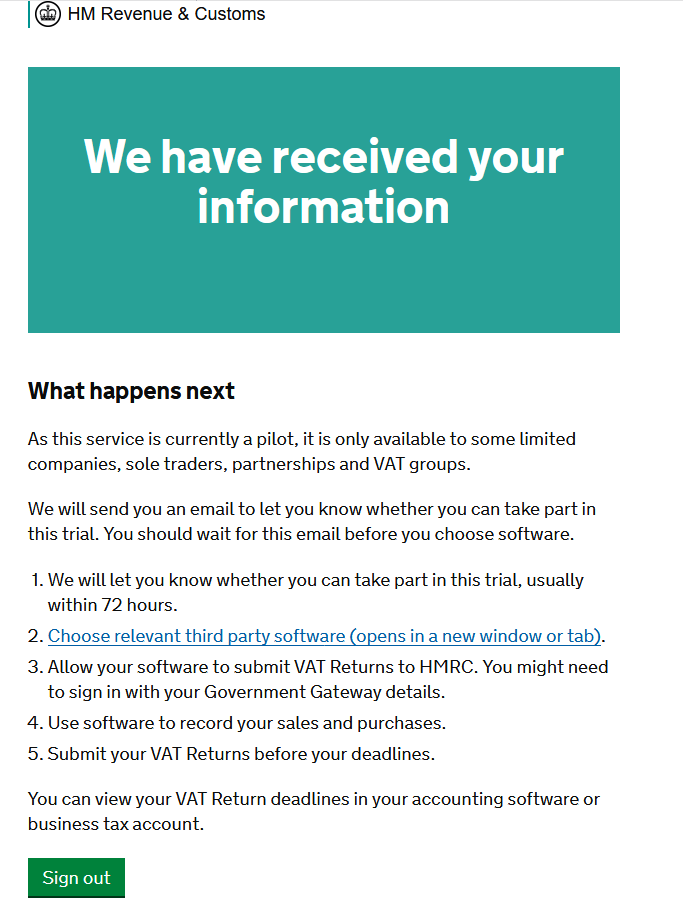

16) Next page should be confirmation you’ve done all you need to…for now.

As it suggests, patience from here. Hopefully within a few working days you’ll get a further email from HMRC confirming acceptance onto the pilot. Once you’ve got that, move on to the FreeAgent bit which is a doddle/lightning quick in comparison (other software packages will likely have something similar).

****A FEW DAYS DELAY****

17) Hopefully you’ll get an email like the below:

That’s the painful bit done!

FreeAgent settings to tweak

On FreeAgent, go to “Connections” (just under “Settings” (from top right):

Then under the menu you should see a new option “HMRC Connections”:

You should see a page like the below:

Click the big green button, which then takes you to an HMRC page again:

Click “Continue” and you’ll need to provide your 12 digit HMRC gateway ID and password one more time:

Then click “Grant authority”

Following that, you’re done. You should revert back to FreeAgent and see:

From now on, you’ll barely notice the difference. You’ll still submit VAT returns from FreeAgent, only difference of note for you as a user is that you won’t need to put in your HMRC gateway ID and password each time, as there’s a permanent link already set up.

Do I charge VAT when selling services to overseas client?

It’s another “write an answer to a question we get asked a LOT” blog post. This post includes a lot of what NOT to do, covering some of the most common mistakes people make.

It’s becoming increasingly common for even micro UK businesses to have clients outside the UK. For the purposes of this post I’ll be talking about sales of:

– services rather than physical products,

– NOT “digital services” for the purposes of VAT MOSS (ie bespoke work you’re doing, rather than selling a “make once sell many” eBook/app/similar),

– sales that are B2B rather than B2C (ie you’re selling to an overseas established business, rather than an end consumer),

– from a UK supplier to an international customer.

The key thing that can get complicated is where is the place of supply deemed to be, and the above are key in making that decision. Where all the above apply, the place of supply is deemed to be where the customer is based (hence not in the UK), so no UK VAT should be charged.

Very brief outside scope vs exempt/zero rated

It’s also important that these sales are outside the scope of UK VAT, rather than being a sale that’s zero rated or exempt from UK VAT. If you think this sounds pedantic, it certainly isn’t if you’re on the flat rate scheme, as your FRS % isn’t chargeable on outside the scope sales, but is chargeable on zero rated/exempt sales (despite no VAT being charged).

How to deal with this correctly on FreeAgent

The key section is “Contacts“. I appreciate some of you only use this for client name for your own internal purposes and nothing more, but this is one situation where completing at least a little more information is compulsory.

Key things are:

1) Ensure you change the country drop down from its default United Kingdom to the appropriate country. This is NOT just for show.

2) Check the setting slightly further down. This will default to what’s normally the correct setting, but where you’re selling services internationally, B2B, you want it to show “Charge VAT – Only if contact is also based in the United Kingdom VAT area“.

With those settings as above, when you then go on to raise a sales invoice to that client from the “Work” –> “Invoicing” section of FreeAgent, it should correctly be treated as outside the scope of VAT.

This means not only will you not charge VAT to your client, but the sale won’t appear at all on your (UK) VAT return.

Extra possible quirks

A few extra things to consider:

- EC sales lists – no additional tax is at stake, but where you sell services to EC countries, you’ll likely need to start submitting EC sales lists. These are relatively straight forward and can be submitted online, they’re basically just a summary of your European customers, their country, their local VAT number, and total value of your sales to them.

- B2C sales – if your client is an end consumer, but you’re still selling a bespoke service internationally, then you should change the “Charge VAT” setting to “Always”. Reason being for B2C sales typically the place of supply is deemed to be where the supplier is based (rather than customer), hence sales are deemed to happen in the UK.

- Sales of “digital services” – the B2C sales rule above was to some extent abused by the likes of Amazon who were able to set up shop in low VAT countries like Luxembourg, so if a UK consumer wanted to buy an ebook, they’d pay 15% VAT to Amazon, or 20% VAT to a UK supplier, hence giving Amazon an unfair advantage as taxes made their prices lower than local competition. Therefore new rules were introduced from 1 Jan 2015 called VAT MOSS (or VAT Mini One Stop Shop). These meant where you’re selling “digital services” (this would be most things where you create it once then can re-sell an identical item lots of times, eg ebooks, apps, music/video etc) to an EU consumer, you need to charge VAT based on where your customer is. This is a bit of an admin nightmare for micro businesses, as you need your online shop to be set up to gather various bits of information from your client and charge their local VAT rate accordingly…then send this info on once a quarter, together with payment of international VAT. This is a complex area so no great detail gone into here.

- Sales of physical products – this very rarely applies to our typical client base, so again I won’t go into details here.

Where should I allocate the annual return fee on FreeAgent?

Shortest blog post ever…but answers a question we get asked a LOT.

Q – Which category should I put my £13 annual return fee to on FreeAgent?

A – It doesn’t really matter which category you put it to. Sundries, accountancy fees, legal & professional, all are equally correct.

Key thing is ensure you override FreeAgent’s “Auto VAT” to “0%” as there’s no VAT on Companies House fees.

Why am I suddenly suffering NICs when I wasn’t before?

From January 2015 (“Month 10” of 2014/15 tax year), many directors of small companies taking salaries up to the personal allowance will find they’re suddenly stung by NICs when they weren’t in the previous month…what’s happened?

You’ll see the image above for month 10 of 2014/15 for a one person company paying £833/month. Boxes highlighted in red above show salary, employEE NICs suffered, employER NICs added, but then that the employment allowance effectively waives the employER NICs. Net effect only the employEE NICs are suffered.

Background

For the last few tax years (up to but not including 2014/15) accountants were generally agreed on what the “best” salary to take was, when you were in full control of the company, hence able to fully choose your salary/dividend mix. It’d be the NIC threshold, which is typically a bit lower than the personal allowance.

In 2013/14, this amount was £641/month. Paying slightly above this wouldn’t trigger a personal tax liability, but it would trigger NICs…both employER and employEE. In the majority of cases, suffering both these NICs would outweigh the corporation tax saving of the slightly higher tax, so paying more was counter-productive.

How is 2014/15 different?

In 2014/15, the equivalent of the above £641/month is £663/month. However, a small spanner was thrown into the works in the form of the “employment allowance”. This basically meant that the first £2k of employER NICs suffered by a company would be waived. Therefore paying slightly above £663/month does still lead to employEE NICs, but no employER ones. Geeky calculations show that there is a modest overall tax saving to be had by doing this, as the corporation tax saved slightly exceeds the employEE NICs suffered.

Therefore for the first year in a while, a lot of micro business owners are taking a salary that does lead to some NICs being suffered. Worth also mentioning here that many more won’t as they’ll have gone for the “easy” option of paying £663/month…very slightly more overall tax paid, but many argue not worth it for the extra admin. There is no “right” answer.

£833/month means that over the year, the NIC threshold will be breached, but it’s still below the personal allowance, meaning no income tax is suffered. If the salary were to go above £833/month, then income tax would be suffered as well, making it not worthwhile from a tax minimisation perspective.

How do NICs work for employees?

EmployEE NICs are a deduction from the gross salary, so the employEE foots the bill (hence the name). EmployER NICs are an addition to the gross salary, so the employER foots the bill (hence the name).

For “normal” employees these are calculated on a month by month basis, with whatever was paid in previous months being irrelevant in the current month’s calculation. Therefore NICs on “normal” employees tend to be fairly constant throughout the year, obviously changing a bit if/when salary increases/decreases.

What about directors?

To prevent some quirky ways those in charge could exploit the above (mainly by paying all their annual salary in one month each year), HMRC decided that director NICs should be done on a cumulative basis.

Each month is no longer looked at in isolation, you’re given a certain allowance from the beginning of the tax year, with no NICs suffered until it’s reached, then NICs suffered on everything following that.

For those paying £663/month, even at the end of month 12 they won’t quite breach this threshold (they’ll be trivially below it).

For those paying £833/month however, the threshold will be met part way into month 10. Therefore whilst you’d have been happily paying £833 gross pay = net pay for the first 9 months, suddenly employEE NICs are suffered in month 10, and indeed they will be in months 11 & 12 too.

How do I pay this?

There’s a variety of ways you can pay this, see here. If the company is small, the liability can be paid quarterly, meaning just one payment required in April for the NICs suffered in Jan-Mar inclusive.

Yuck, wish I didn’t have this

Potentially if you’ve been paying £833/month and now decide you’d rather not have the faff of making deductions and paying them over to HMRC, then if your month 10 payroll hasn’t yet been filed, it’s not too late.

If you prepare and file payroll for months 10-12 with a salary reduced to £153/month, you’ll end up below the NIC threshold. Reasons being:

12 x £663 = £7,956 (below NIC threshold)

12 x £833 = £9,996 (above NIC threshold)

9 x £833 + 3 x £153 = £7,956 (below NIC threshold)

IPSE/PCG tax treatment and how to enter on FreeAgent

A lot of contractors will purchase membership with IPSE (the association of Independent Professionals and the Self Employed, previously PCG – Professional Contractors Group). They predominantly provide assistance against IR35, but also other things which impact many contractors.

Question many people ask is what is the tax treatment of the membership fees? IPSE are pretty clear on it here. In summary, you can reclaim VAT on the cost, but it’s not an allowable expense for corporation tax purposes.

Next question for FreeAgent users is how to correctly account for that in the software. As things stand, I don’t think there’s any suitable code which gives it the correct tax treatment. Whilst there is a “subscriptions” code, FreeAgent assumes there’ll be no VAT on these costs (which can be easily overwritten, just change the “Auto VAT” option) but also that it will be allowable for corporation tax (which can’t easily be overwritten).

FreeAgent does however give you the ability to create new codes, with whatever tax settings you choose. Step by step instructions on how we recommend doing it below:

- Go to “Settings” –> “Income & Spending Categories”.

- Click “Add New” –> “Admin Expenses category”.

- I’d suggest calling it “IPSE Membership”, but this is free text, so put what you like.

- Nominal code, I’d suggest “357” so it sits as near as you can get it to subscriptions.

- Reporting name “Subscriptions to professional and trade bodies”.

- Make sure you remove the default tick in “Allowable For Tax”.

- Leave VAT at “Standard rate”, then “Create Admin Expenses Category”.

Now, whenever you allocate a payment to that code, FreeAgent should correctly reclaim VAT (barring unrelated factors like whether or not you’re on the flat rate scheme) but not allow it for corporation tax purposes.

RTI filing deadlines with FreeAgent

RTI filing deadlines are causing confusion for a lot people (like everything HMRC related!)

RTI is very different to every other tax in terms of deadlines. VAT, corporation tax, self assessment, for all of those you wait until the period ends, and then have a certain amount of time after the end date to file the return. RTI is different, giving you much less slack.

Basic rule (that you can realistically ignore)

The basic rule is you need to submit your payroll information to HMRC for any given period on or before the date staff are paid. For the purposes of this blog, and as FreeAgent doesn’t support weekly pay, we’re only going to discuss monthly payrolls.

BUT…HMRC have no idea when you physically pay your staff, as they don’t have direct access to your bank statements (thank goodness). So how do they know?

Let’s ignore what the rules say for the time being, and look at the information HMRC actually do know/find out when you submit:

– the date the payroll is said to occur. In theory this should be the date the payroll is paid (but in reality it might not be).

– the date you actually clicked the buttons to submit the payroll.

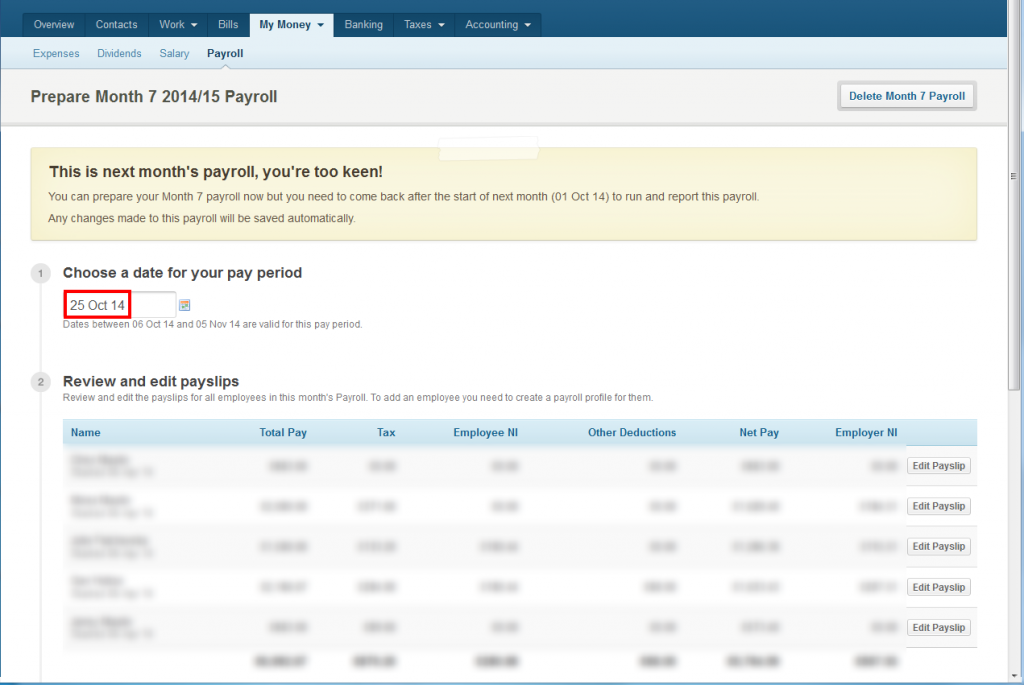

Above is a screen print (with sensitive data blurred) of a month 7 payroll period (October), as drafted on 11 September 2014.

Key thing I want to flag is the date highlighted in red. In this example, 25 Oct 2014. That date is to some extent editable, but whatever is chosen for it becomes the filing deadline. It needs to be a date between 6 Oct 14 and 5 Nov 14. FreeAgent defaults to 25th of each month, and I see no good reason to change this consistently, it’s as good a date as any.

This business is a bit ahead of themselves, month 6 was submitted early (deadline for it would have been 25 Sep, it was submitted 9 Sep), but that’s fine, no harm in submitting early.

What are the default FreeAgent filing deadlines?

As FreeAgent defaults to set the payroll date to 25th of the month, that is also the filing deadline, so:

Month 1 – 25 April

Month 2 – 25 May

Month 3 – 25 June

Month 4 – 25 July

Month 5 – 25 August

Month 6 – 25 September

Month 7 – 25 October

Month 8 – 25 November

Month 9 – 25 December

Month 10 – 25 January

Month 11 – 25 February

Month 12 – 25 March

What if I only notice on 26th of the month that I haven’t submitted the payroll for that month? Well, you can be cheeky, and edit the date, putting it back a day, then submit (so it’s on time). Not really recommended, and of course there’s only a small window that this is physically possible anyway (absolute latest 5th of the month afterwards). Plus, for the time being there’s no penalty for late submissions.

Why don’t I set it to 5th of the month after to give me maximum time to file? Theoretically you can…but I wouldn’t recommend it. People tend to find having a payroll date of 1st-5th the month confusing. Reason being it means for profit and loss purposes the payroll is in a different month to for payroll purposes. Eg take a company with a year end of 31 March. If they ran their payroll dated 5th of the month, then “Month 12” payroll would be processed 5th April, making it in the year after the year it realistically related to.

HMRC have recently agreed to delay the introduction of late filing penalties for companies with <50 employees until March 2015. Therefore, at present, even if you’re late (as many companies have been multiple times), there’s no penalty. Be aware this will change, it was going to be from October 2014, but due to teething problems all round, small companies have another 6 months respite.

If an RTI return is submitted late, FreeAgent will ask you for the reason. The options are:

– No other reason applies

– Notional payment: Payment to Expat by third party or overseas employer

– Notional payment: Employment related security

– Notional payment: Other- Payment subject to Class 1 NICs but P11D/P9D for tax

– Micro Employer using temporary “on or before” relaxation

– No requirement to maintain a Deduction Working Sheet or impractical to report work on the day

– Reasonable excuse

– Correction to earlier submission

Reality is most of those are “big boy” only things where there are complex issues at play. The main one most FreeAgent users are realistically going to use will be “No other reason applies”.

If the real reason is “I forgot”, this does not count as a “Reasonable excuse”. Neither does your hamster dying or you having man-flu on the submission date.

So realistically, what should I do to stay on top of things? I’d recommend setting a monthly recurring reminder in your calendar, perhaps dated 6th of each month, to submit the month’s payroll. Yes, it’ll be almost 3 weeks early, but better that than doing the reminder for 25th, then if you’re on holiday that week, or it’s a Saturday you’ve got to mess around with dates or accept it’s late.

In terms of when can you physically pay the salary, to stay on the right side of the law, I’d recommend always paying yourself a bit to late rather than early. Realistically HMRC won’t know when you transfer the funds unless they do an enquiry and demand the information (highly unlikely), but better to be safe than sorry.

Any queries/comments, feel free to post below.

FreeAgent user – how much dividend can/should I take?

It’s a question we get asked a lot. There’s two important and completely separate considerations you should have when considering paying a dividend.

1) Can my company afford it?

2) Is it a good idea from a personal tax perspective?

Company retained profit

Let’s take the company side first. Dividends can only be paid out of retained profit. This means what’s left after you’ve set aside enough to pay all the company’s liabilities, including tax bills even if the due date is some time off.

Fortunately, FreeAgent does all the hard work for you, summarising it all into one number. Bizarrely they choose to hide this number in the very bottom right of the overview page, but it’s there as “Carried forward/distributable“.

See the example above for a business in a fairly healthy position. What this figure represents is what you’d hypothetically have left if you ceased trading today, collected in all debts owed to the company, and paid off any debts owed by the company. This is why it’s the absolute maximum dividend you can take, as otherwise you’d be leaving the company in a position where it can’t afford to pay its debts (ie you’d be defrauding the creditors).

See the example above for a business in a fairly healthy position. What this figure represents is what you’d hypothetically have left if you ceased trading today, collected in all debts owed to the company, and paid off any debts owed by the company. This is why it’s the absolute maximum dividend you can take, as otherwise you’d be leaving the company in a position where it can’t afford to pay its debts (ie you’d be defrauding the creditors).

If this number is negative, you can’t take a dividend at all. Your company is already insolvent, meaning it owes more to others than the value of its assets (ie negative equity). Taking a dividend anyway in this situation is technically illegal.

Inevitably as with anything, the data FreeAgent throws out is only as accurate as the data put into it…so make sure FreeAgent is up to date and that things like the bank balance in the software agrees to what’s _actually_ in the bank before making any significant decisions.

Also (stating the obvious) always clearing this figure down to £nil isn’t a great idea. Good to leave a nice buffer there in case things take a turn for the worse.

Your personal tax situation

Completely separate to the above, the question comes in over whether it’s tax efficient to take a further dividend at this point.

What other earnings have you had in the tax year to date? Dividends suffer 7.5% (barring first £2k for 6 Apr 2018 onwards) whilst a basic rate taxpayer. As a higher rate taxpayer they’ll suffer 32.5% personal tax. If you get above £100k total income, then the effective rate is higher still.

The key time for this is 5th/6th April. It makes no difference whatsoever what your company year end is. The personal tax you pay on dividends revolves around the personal tax year, 5th April.

Therefore especially this time of year (mid March at time of writing), if you’re thinking about taking a big dividend, it’s worth giving it a bit of thought. Does it make sense to take that dividend quickly now, or is it beneficial to hold fire until 6th April if you can?

Delaying until post 6th April will always delay the personal tax…but if it only delays it, is it worth it? Also, if you’ve only earned (say) £20k this tax year, and expect to earn (say) £60k next tax year, it definitely makes sense to rush through that dividend now. Nearly always better to pay a small amount of tax soon rather than a much larger amount later.

If you’ve been using FreeAgent for a while, you can easily see your relevant figures for the current tax year from the “My money” tab.

Top tip – you can also go to the “Taxes” –> “Self assessment” tab, click the current tax year and have a look at what the liability currently shows as. Then click “Edit details” in the top right, stick in a figure you’re thinking about taking in the “Dividends” box then “Save changes”. See what your liability is now. This gives you an easy way to get a good idea of what extra personal tax you’ll have to pay if you take that extra dividend. NB ensure you then delete this hypothetical dividend figure!

Again, the data FreeAgent chucks out is only as good as data that’s been entered…so check it’s correct before making significant decisions. Also be aware as things stand FreeAgent won’t account for student loan repayments, so that may be a hefty additional amount to pay over and above the figure FreeAgent quotes. It also doesn’t currently account for payments on account (EDIT – I gather this has just been changed, March 2014). However, I anticipate both these things will change in the fairly near future.

Again, the data FreeAgent chucks out is only as good as data that’s been entered…so check it’s correct before making significant decisions. Also be aware as things stand FreeAgent won’t account for student loan repayments, so that may be a hefty additional amount to pay over and above the figure FreeAgent quotes. It also doesn’t currently account for payments on account (EDIT – I gather this has just been changed, March 2014). However, I anticipate both these things will change in the fairly near future.

For Maslins clients we tend to have a look at their personal tax position in February/March to advise. It’s generally a quiet time for us (after January tax return rush) and it’s the time you most want to be thinking about this…as simply waiting a day can potentially have a massive impact.

The boring legals

You should produce the board minutes and dividend voucher for each dividend. Once you’ve paid the dividend, uploaded the bank transaction to FreeAgent, and explained it, you can then easily get templates for these from “My money” –> “Dividends”. Strictly speaking you should print these out, sign and date, then file away somewhere safe.

Five most common FreeAgent user mistakes

We’ve been working with FreeAgent for about 4 years at time of writing, with currently 250+ clients actively using the software…in that time we’ve inevitably had to fix a lot of mistakes. Many can be made even by very intelligent users following a logical (but slightly flawed) set of steps.

In no particular order these are:

Duplicating sales by wrongly explaining bank receipts,

Duplicating costs by using bills and wrongly explaining bank payments,

Duplicating bank transfers,

Incorrect VAT treatment on international sales,

Taking out more cash than you’re entitled to.

1) Duplicating sales by wrongly explaining bank receipts

Cause – Raising an invoice, then when it’s paid, marking the bank receipt as “sales” instead of “invoice receipt”.

Problem – By doing this, you’ve got the turnover (and potentially VAT) from the sale in the accounts twice, and despite the customer having paid, your invoice will still show as unpaid because the receipt isn’t correctly allocated to the invoice.

Potential further problem when client tries to fix(!) – What normally happens is a little further down the line the client sees the invoice showing as unpaid, so clicks “mark as paid”. This doesn’t solve the problem. Yes it means the invoice is now showing as paid, but it means FreeAgent adds a manual entry to the bank, duplicating the receipt. So your bank no longer tallies up with reality.

Rectify – Go back to uploaded bank receipt and change from “sales” to “invoice receipt” and allocate to the appropriate invoice. If you’ve already done the “mark as paid” thing, then you’ll need to manually delete the bank entry that created. If you’ve filed VAT returns, locking the transactions, then you’d probably best speak to your accountant rather than DIY a fix as you’ve likely got a few knock on issues.

2) Duplicating costs by wrongly explaining bank payments

Cause – Exactly the same as above, but with bills. People raise a “bill”, then when they pay it, explain the money out of the bank as “payment” instead of “bill payment”.

Problem – Again, this means the cost is in there twice, and whilst the cash has come out of the bank, the bill still shows as unpaid.

Rectify – Change the money out of the bank from “payment” to “bill payment” and allocate to the appropriate bill.

Recommendation – We personally recommend simply not using bills. For most small businesses where realistically costs are small and virtually always payable immediately, there’s no need.

3) Duplicating bank transfers

Cause – Explaining both sides of the same transaction independently so FreeAgent sees them as two separate, unrelated transactions. So, you’ve got a savings account attached to your current account and you’re doing just what your mommy/accountant told you to do and putting some cash aside for your taxes/a rainy day. Great.

However, what often happens is you first upload the current account statements, and explain the payment out of the current account correctly as a transfer to the savings account. You then upload the savings account statement, and the receipt you mark as a transfer from the current account. Right? Well, sadly not.

Problem – When you explain the current account side as a transfer to the savings account, FreeAgent automatically puts a balancing transfer in to the savings. Then if you explain the uploaded transfer in to the savings as a transfer in, it automatically puts a balancing transfer out in the current account. So you end up with it in both accounts twice, throwing out the balances on both bank accounts.

Rectify – What you need to instead do is look for the “use existing manual entry” option when explaining the savings side (or whichever side you explain second). This tells FreeAgent that the uploaded transaction isn’t new, it’s simply the uploaded version of what FreeAgent already knows about from you explaining the other side. So choose one of the uploaded transfer transactions, and amend the explanation, opting for usage of the existing manual entry.

Alternative – If a savings account only has transfers to/from the current account and the occasional bit of interest, you can potentially never bother to upload statements to the savings account. The transfers should appear automatically from you correctly explaining the current account side, so you should simply need to manually enter the bank interest every now and again.

4) Incorrect VAT treatment of overseas sales

Cause – Manually marking sales to international clients as 0% VAT instead of telling FreeAgent the client is international (difference between “zero rated” and “outside the scope” of VAT).

Problem – If you’re on the “normal” VAT scheme, whilst doing the above is wrong, it won’t cause _too_ much of a problem. Your VAT liability will be correct, just the net sales figure will be wrong.

However, if you’re on the flat rate scheme (FRS) as many freelancers/contractors are, then you lose out massively with this mistake. Reason being international sales should be outside the scope of VAT, which means they are NOT included in FRS calculations. Zero rated sales (how it’s treated if you simply manually alter the VAT rate to 0% on an invoice) ARE included in FRS calculations. Making this mistake can therefore mean you pay over your FRS % on all your international sales when you shouldn’t be, which could be expensive.

Rectify – When you get an international client, ensure you use the “contact” section of FreeAgent properly. Set the country drop down correctly (as this impacts VAT, it’s not just for show on the invoice), and ensure where no VAT is to be charged that the “Charge VAT” drop down is set set to either “Only if contact is also based in UK” (what it defaults to) or “Never”.

Exception – Perhaps worth mentioning here that if your international client is an end consumer (rather than VAT registered business) and is in the EU, then normally you would still charge them 20% UK VAT, so the above setting should be changed to “Always”.

5) Taking out more than you’re entitled to.

Cause – seeing lots of cash in the company bank account, forgetting/ignoring the fact you’ve got VAT/corporation tax bills on the horizon, and taking more cash than you should out for yourself. Ok, so this problem isn’t remotely restricted to FreeAgent misuse, but thought it worth mentioning anyway, as it is something new small Ltd Co owners often struggle with.

Problem – Firstly, it’s illegal to take a dividend that puts the company into an insolvent position. Reason being you’re defrauding the creditors, taking funds from the company that you’re not entitled to, as they should be set aside to clear company debts.

Secondly, it then means at some point not too far down the line the debt becomes payable, and your company quite probably doesn’t have enough cash to pay it. At this point you moan to your accountant about how taxes are really high and life’s unfair, and are amazed that they have little sympathy. At this point, you then either don’t pay the tax (leading to potential penalties and/or interest), or you scrabble around personally to try to find some cash to put back into the company to clear them. Either way, not good.

Rectify – Ok so this isn’t much help if you’ve already done it…but my only advice is don’t allow yourself to get into that position in the first place. FreeAgent makes this as easy as it can for you. The very bottom right figure of your FreeAgent overview page should be marked “Carried forward/distributable”. Provided your FreeAgent account is up to date and accurate, that’s the absolute maximum you can take as dividends whilst still leaving enough assets in the company to pay debts building up. I wouldn’t recommend clearing it down to £nil every time, doing that means you’d literally just have enough to clear debts…with possible problems if a client doesn’t pay you, or unexpected costs arise. Always a good idea to keep a healthy buffer in there, and also consider your personal tax position before declaring dividends.

Accountants/experienced users, any common ones you feel we’ve missed off? Add them in the comments below!